DePIN Tokenomics 101: The Economics of Early Issuance

Data from Cambridge Associates confirms that crypto and blockchain VCs outperform traditional VC on account of structural advantages. Tokens enable faster value accrual and earlier price discovery, which compounds over the life of a protocol. Alongside equity exposure, token allocations allow investors to participate across both network growth and company value creation (Cambridge Associates via Arche Capital). These dynamics are amplified in DePIN, where token issuance directly governs real-world infrastructure deployment. Crypto is here to stay, and we will continue to see new and increasingly sophisticated uses for tokens as the industry matures.

As a result, the earliest design decisions around token issuance matter far more than in traditional venture models. This is especially true in DePIN, where tokens are not just financial instruments but coordination tools for real-world infrastructure. In the early stages, protocol founders must balance token printing: issuing enough tokens to bootstrap the network and reward early contributors, while carefully managing emissions for early stakeholders and investors to preserve long-term sustainability.

On average, DePIN protocols print approximately 45% of total supply within the first two years to bootstrap and grow the network (Dylan Bane). Managed well, early issuance can drive healthy growth and set a solid foundation for sustainable token demand as the network matures. This article outlines practical approaches for managing token emissions, unlocks, and early stakeholder rewards in the crucial first phase of a DePIN project.

Early Stakeholders: Distinct Roles, Distinct Incentives

Early-stage networks involve several groups whose incentives don’t always align: founders, early investors, infrastructure providers, and the first wave of users. Each contributes something essential to the network, but each also experiences token emissions differently. Founders and investors often hold larger allocations that unlock over time, while operators and early users depend on ongoing emissions to justify deploying hardware or contributing data or delivering services.

Because tokens offer much earlier price discovery than traditional VC equity, stakeholder management during the period when the protocol is still proving its business model is especially critical. If emissions, unlocks, and incentives aren’t sequenced intentionally, early price signals can become distorted, introducing inflationary pressure, misaligned expectations, and volatility at a point when the network most needs clarity. Hivemapper offers a useful illustration of this dynamic. Periods of price pressure around investor unlocks can be understood less as a flaw in the protocol and more as a reflection of its current stage of development, where infrastructure deployment, usage growth, and supply expansion are still converging. As Hivemapper continues to mature and real network demand becomes more observable, market signals are likely to stabilize alongside clearer expectations around long-term value creation (see more in Hivemapper case study). On the opposite side, sharing too little value with early adopters can lead to sluggish and stagnant early growth.

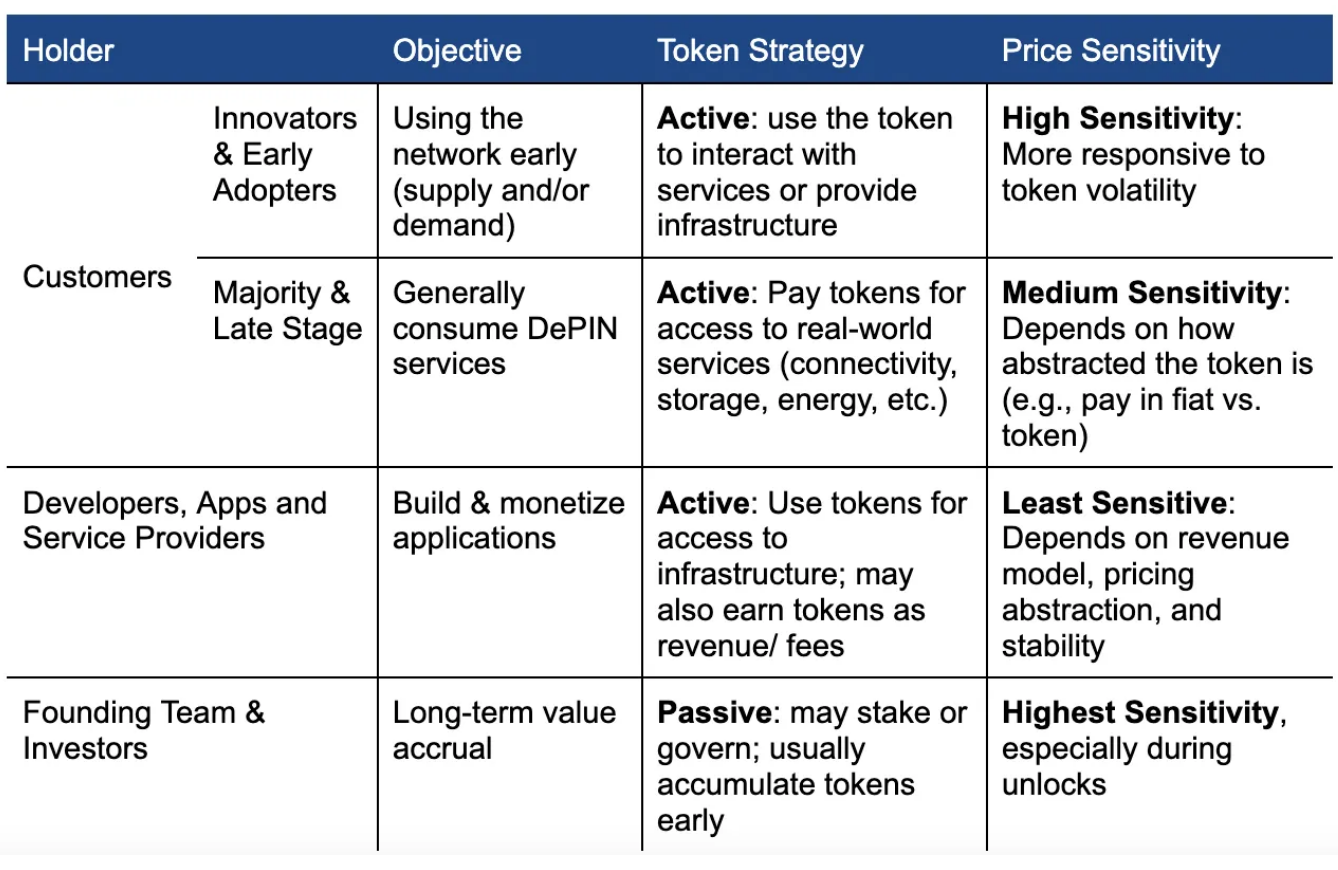

For a deeper breakdown of each stakeholder group and the incentive structures behind them, readers can refer to DePIN Tokenomics 101, which outlines a detailed framework for classifying ecosystem participants and designing balanced token systems. Below is a chart from that article that details the different types of stakeholders in a DePIN network.

See A Practical Framework for Early Token Allocation below for an example stakeholder allocation.

From Genesis to Growth: Token Issuance

In DePIN, token launches often occur before product-market fit (PMF) is fully established, and can be driven by market cycles, capital requirements, or seed term sheets. Networks like Helium have gone through multiple iterations of their token models, even after attracting real usage, because PMF in DePIN is validated when it has been market-tested both operationally and through token performance. This means early token printing needs to be flexible enough to evolve as the network learns.

The below DePIN and infrastructure networks illustrate the different ways projects approach this challenge. These examples span compute, storage, wireless, and indexing which are core DePIN primitives.

Protocols That Redesigned Tokenomics Post-Launch

These networks had to adjust their tokenomics in response to real-world usage, adoption patterns, or misaligned incentives:

Helium (HNT, Mainnet 2019, LoRaWAN and Mobile Networks) — Adjusted hotspot and mobile incentives, emission splits, and governance mechanisms to align real-world coverage with token economics. (helium.foundation, also see the Helium case study for highlights)

Livepeer (LPT, Mainnet 2018, Videostreaming) — Tuned staking reward curves and delegator incentives to balance network growth with token supply. (livepeertoad.com)

Sia / Skynet (Siacoin, Mainnet 2015, Cloud Storage) — Adjusted storage host and renter rewards over time to reflect hardware costs and network usage, and later established a foundation funded via a block subsidy. (Sia)

Protocols with Tokenomics Designed Around Measurable Network Performance

These networks designed their tokenomics with flexible, parameterized mechanisms from the outset, reducing the need for structural redesigns:

Filecoin (FIL, Mainnet 2020, Cloud Storage) — Core issuance and flexible issuance for storage mining rewards were baked into the protocol at launch. (filecointldr.io, see summary in Guiding Principles for Responsible Token Issuance.)

The Graph (GRT, Mainnet 2020, Blockchain Index) — Built-in Inflationary issuance (~3% annually) for Indexers, Curators, and Delegators has been in place since launch. (the Graph)

Early token printing should loosely track economic activity, infrastructure growth, usage, or consumption. Dynamic emissions, reward curves, or milestone-based unlocks allow teams to align token performance with real-time data. The key is acknowledging that DePIN tokenomics are living systems that mature alongside the network and require thoughtful adjustment as PMF becomes clearer.

Issuance Risk as the Network Takes Shape

When token printing is misaligned in the early stages, the consequences tend to compound over time if left unchecked. Over-emission can dilute value before meaningful demand exists, creating downward price pressure that discourages participation from operators, users, and long-term investors. Once confidence erodes, even protocols with strong fundamentals can struggle to recover, especially in volatile markets and when token price becomes an implicit signal of network health. Bitcoin price swings can range from peak to trough of approximately 80% (The Defiant). Early-stage tokens are more susceptible to losing the majority of their value in bear markets unless they can prove their value.

Another common risk is front-loading incentives before the protocol has validated real demand. If early rewards are too generous or unlocks happen too quickly, participants may optimize for extraction rather than contribution. This often results in shallow engagement, weak retention, downward price pressure, and ecosystems that look active on-chain but fail to translate into sustainable usage or revenue.

Finally, poor token design can limit a protocol’s ability to adapt. DePIN networks evolve through experimentation, yet rigid emission schedules or politically difficult token changes can lock teams into suboptimal paths. Thoughtful token printing should preserve optionality, giving projects room to learn, adjust, and mature.

Guiding Principles for Responsible Token Issuance

Responsible token printing starts with alignment before acceleration. Early emissions should support real network growth and not just participation metrics or short-term optics. This means designing issuance schedules that reward contributions such as infrastructure uptime, service quality, or real usage.

When we look at Plume’s airdrop strategy, we see this in action: Plume used a staged airdrop before and around its mainnet launch, rewarding early test-net participants, community engagement, and activity that correlated with long-term interest in the network. Recipients could choose to claim early or delay claims for a larger bonus post-mainnet, creating alignment between early participation and sustained engagement. This preceded notable increases in protocol activity and a new strategic partnership with the Tron network announced months after the airdrop. Daily users averaged less than 1M per day and increased to over 2M post airdrop. (see Free Money to Sticky Users, What Makes an Airdrop?, and the corresponding Plume Dune dashboard for more performance metrics)

Second, emissions should scale with protocol metrics and performance to support growth. One way to build that flexibility is to link token issuance to specific protocol milestones or metrics instead of rigid timelines. Milestone-based unlocks tie token releases to measurable achievements, such as launching mainnet, hitting usage targets, onboarding strategic partners, or reaching TVL/active user thresholds and ensure that tokens are released only when the project demonstrates real progress toward value creation.

One strong example of linking token issuance to network milestones and real utility is Filecoin’s dual minting mechanism. Unlike simple time-based emission schedules, Filecoin’s design incorporates both baseline (performance-based) and simple (time-based) minting to align issuance with actual network growth. Under this model, 70% of the mining allocation is tied to “baseline minting,” which only mints tokens as the network’s total storage capacity increases, while the remaining 30% follows a traditional exponential decay schedule that gradually releases tokens over time. This means the bulk of Filecoin’s issuance is not released on a fixed clock but is contingent on the network achieving measurable storage growth, encouraging sustained contributions from storage providers rather than early speculative issuance (Filecoin).

It’s also useful to distinguish between activation milestones and continuous KPIs when designing milestone-based issuance. Structural milestones, such as mainnet launch, protocol upgrades, or the activation of a new network module, are discrete events that justify step-function changes in token supply. Continuous KPIs, by contrast, track ongoing network health, such as infrastructure uptime, usage volume, capacity growth, or recurring revenue, and are better suited to dynamically adjusting emissions over time.

Finally, transparency is a feature, not a burden. Clear communication around token supply, vesting, and potential changes builds credibility with operators, investors, and users alike. When participants understand how and why tokens enter circulation, they’re more likely to stay aligned through periods of iteration.

A Practical Framework for Early Token Allocation

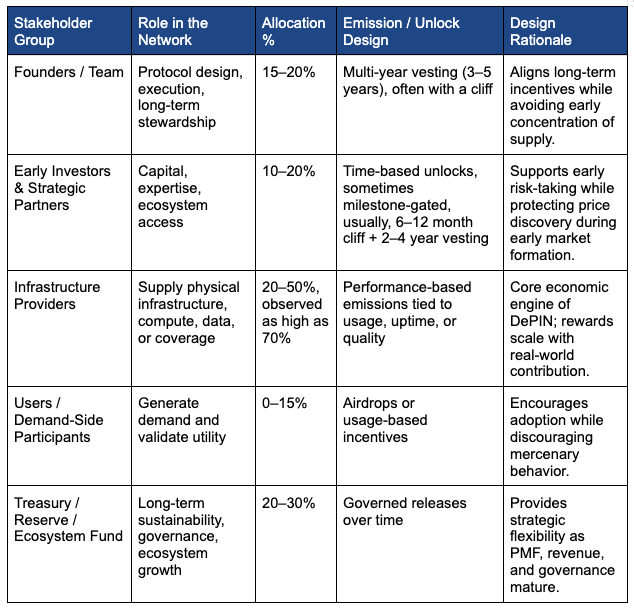

A useful way to think about early token allocation is to separate who needs tokens to build the network from who needs tokens to stay aligned long-term. Infrastructure providers and early contributors should earn tokens through measurable participation — uptime, usage, coverage, or service delivery — so emissions directly reinforce real network growth. Founders and early investors, on the other hand, benefit from longer vesting schedules that reflect their strategic role rather than short-term output.

In practice, this means avoiding large upfront unlocks and instead relying on gradual vesting, milestone-based releases, or performance-linked emissions. Token supply should expand as the network proves demand. This creates a natural feedback loop where growth earns issuance, rather than issuance hoping to create growth.

Most importantly, allocation frameworks should leave room to evolve. DePIN networks rarely get everything right at launch, and early rigidity can limit long-term success. Designing token distribution with adaptability in mind, whether through governance, adjustable parameters, or clearly defined review periods that formalize iteration as part of the system, ensures the system matures alongside real usage, revenue, and demand.

The allocation ranges summarized below are grounded in this framework, reflecting how DePIN networks have translated these incentive principles into early token distribution while preserving flexibility as the network matures.

Observed in: DIMO, Filecoin, Grass, Helium, Hivemapper, Livepeer, Nosana, Render, WeatherXM, and other private client engagements.

Tokenomics as a Living System

Token printing is a long-term coordination challenge that sits at the intersection of incentives, trust, and real-world execution. The most resilient DePIN projects treat tokenomics as a living system. They allow room for experimentation, acknowledge that product–market fit takes time, and design emissions that evolve alongside real usage and revenue. Successful protocols prioritize alignment between builders, operators, investors, and the network itself.