From Free Money to Sticky Users: What Makes an Airdrop?

This article was originally published on Medium on 7/30/2025. Some of the charts and the commentary has been updated as of 1/30/2026. Updated commentary is italicized.

Love ’em or hate ’em, airdrops are firmly embedded in Web3 marketing and fundraising strategies. From Ethereum’s legendary 2016 DAO token distribution to more recent campaigns by projects like Optimism, airdrops have become a go-to playbook for launching tokens and grabbing attention.

But how effective are they at driving real adoption and protocol usage?

On the upside, airdrops increase awareness and act as a lubricant for building an ecosystem. On the downside, giving away free tokens can lead to short-term speculative exits. When token values are high, users are incentivized to sell for profit. When values are low, recipients may still dump the tokens since they represent “free money.” Both behaviors are difficult to recover from in terms of market pricing.

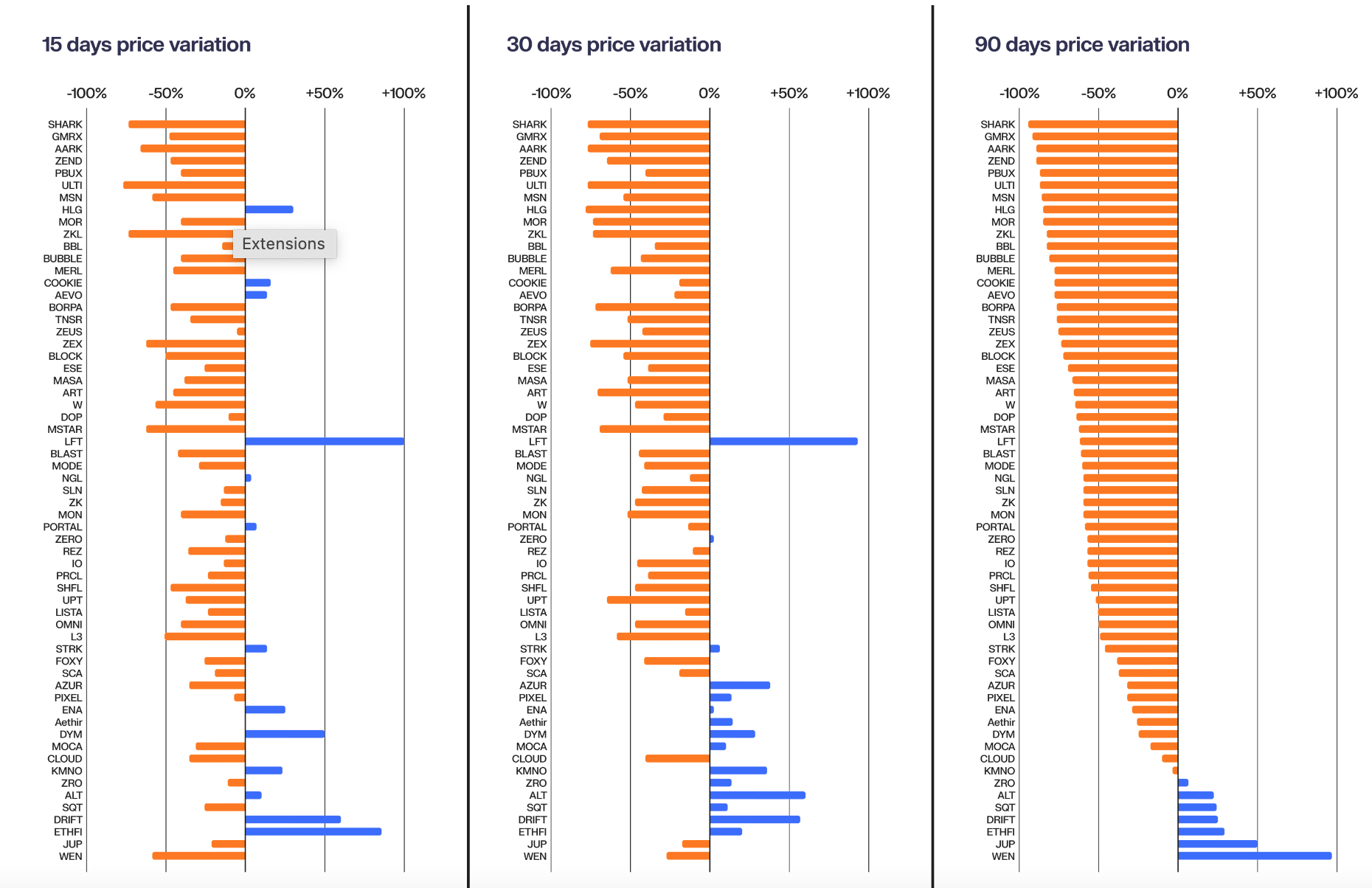

A 2024 study by Keyrock underscores this problem: among 62 projects across six chains, only seven saw higher token prices 90 days after launch. (See chart below.)

According to Rachel Sacks at Hype, airdrops aren’t a lever for token price, nor is the protocol’s value creation flywheel dependent on them. Well designed airdrops can serve as a fast, targeted way to diversify the demand side of a marketplace in addition to bootstrapping supply in DePIN protocols. They can be deployed at TGE and again during major events like feature releases or large-scale onboarding.

Protocols should already have a proven product-market fit (PMF) validated and sound tokenomics before launching an airdrop (see Tokenomics 101 specifically for DePIN builders). Otherwise, they’ll be testing and iterating with a broader, less engaged user base.

Dropping Wisely

So, what separates a successful airdrop from one that just creates exit liquidity?

1. Clear Objective: What Are You Trying to Incentivize?

The most effective airdrops start with a crystal-clear purpose. Are you rewarding early adopters? Bootstrapping contributors? Attracting liquidity? Encouraging governance?

Each goal demands a different design in terms of eligibility, distribution mechanics, and follow-up actions. Without a clear target, it’s easy to confuse “distribution” with “impact.”

2. Sybil Resistance: Rewarding Real Users, Not Just Wallets

Crypto makes it easy to create thousands of wallets and farm airdrops. A shadow economy of airdrop hunters has emerged, with bots and mercenary capital often crowding out real contributors.

Effective Sybil resistance is essential. Whether it’s via on-chain behavior filters, identity attestations, or contribution scoring, protocols need ways to separate genuine users from opportunists.

3. Engagement, Engagement, Engagement

The airdrop is only the beginning. Unless recipients have a compelling reason to stake, govern, contribute or participate, token holders will likely just sell. Combine that with shallow liquidity and the result is a price collapse.

Effective airdrops kick off deeper journeys: incentive programs, access to features, participation in governance, or contributor pathways.

Lessons from the Field: PLUME

The Plume Network is building a modular Layer 1 blockchain designed specifically for real-world assets (RWAs), to become the infrastructure layer for tokenized assets like real estate, private credit, and commodities. The network focuses on usability, access and functionality to integrate with DeFi environments via four core products

Plume Chain: A layer 1 built specifically for RWAs utilizing a unique consensus mechanism called proof of representation.

Arc: Executes asset tokenization combined with compliance services.

Skylink: A cross chain RWA yield distribution leveraging LayerZero’s sync pools for multi-chain functionality.

Nexus: A data layer that facilitates data across different blockchains. (Messari)

Plume launched its native token, $PLUME, with its Season 1 airdrop in January 2025. The approach focused on rewarding early contributors including testnet users, active participation in the Discord, and pre-deposit stakers. To encourage continued engagement, recipients were given two options: claim 100% of allocation at the time of airdrop and receive a 33% bonus for activity post mainnet launch or redeem post mainnet launch and receive a 66% bonus (KuCoin).

In April 2025, Season 1 redemption was suspended in preparation for the upcoming mainnet launch. Plume’s Season 2 airdrop coincided with its mainnet, Genesis, launched June 5, 2025 (Plume via X). Plume continues to integrate large partners and products with a July 7th announcement that one of its products Skylink was integrated into the Tron network (Blockworks).

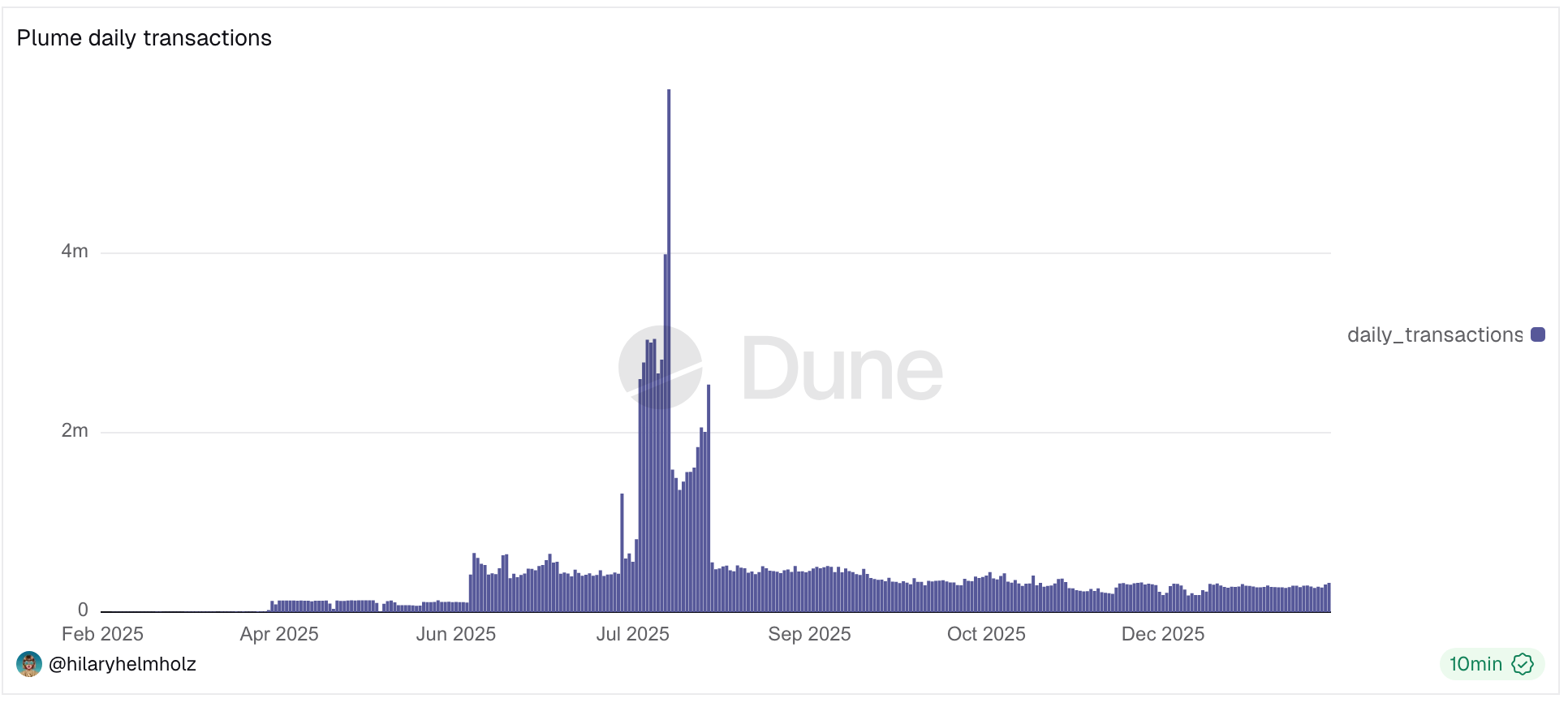

As shown in the below chart, daily transactions have skyrocketed since the announcement of Skylink. Daily transactions have leveled out to to pre announcement levels.

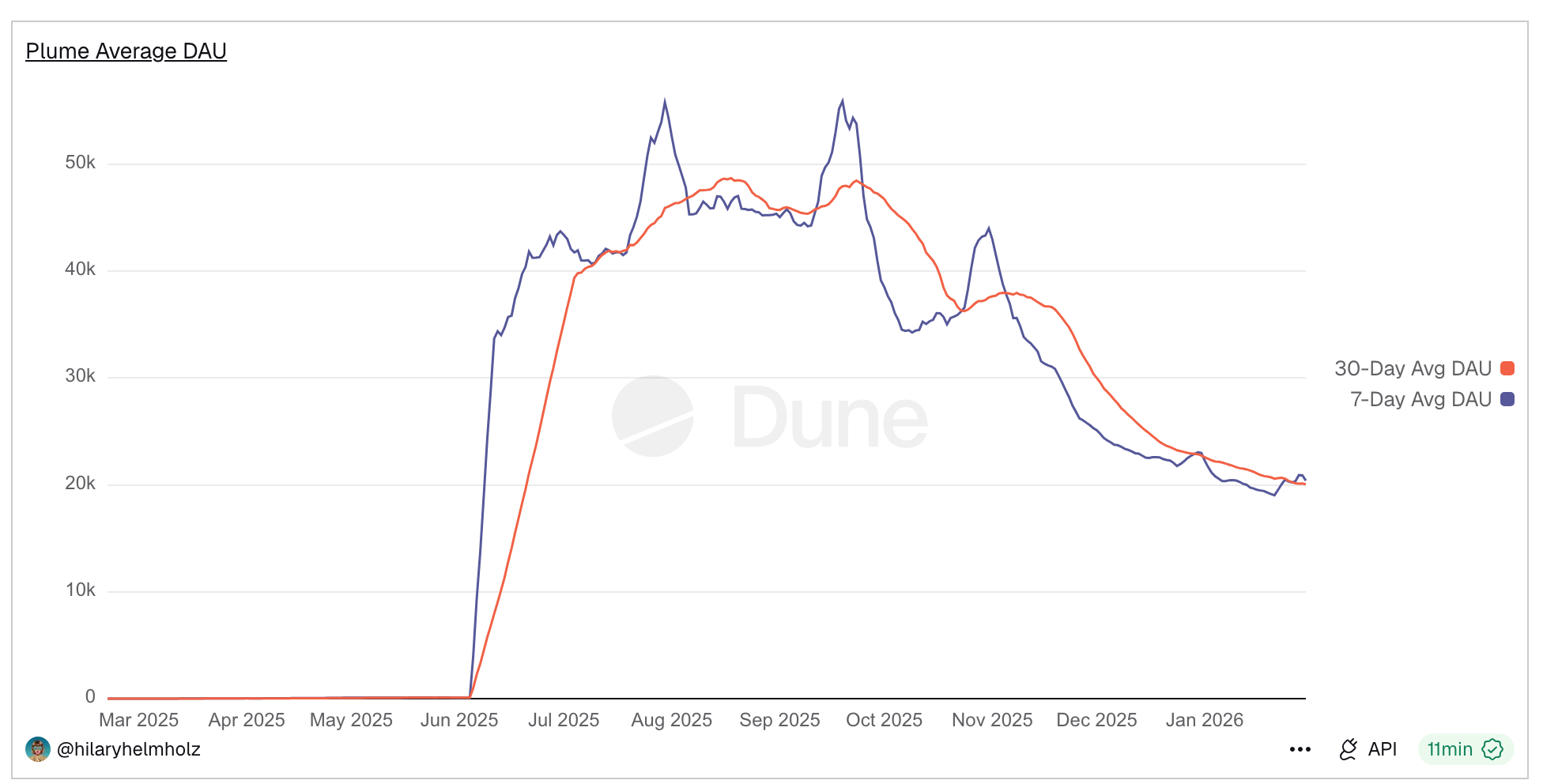

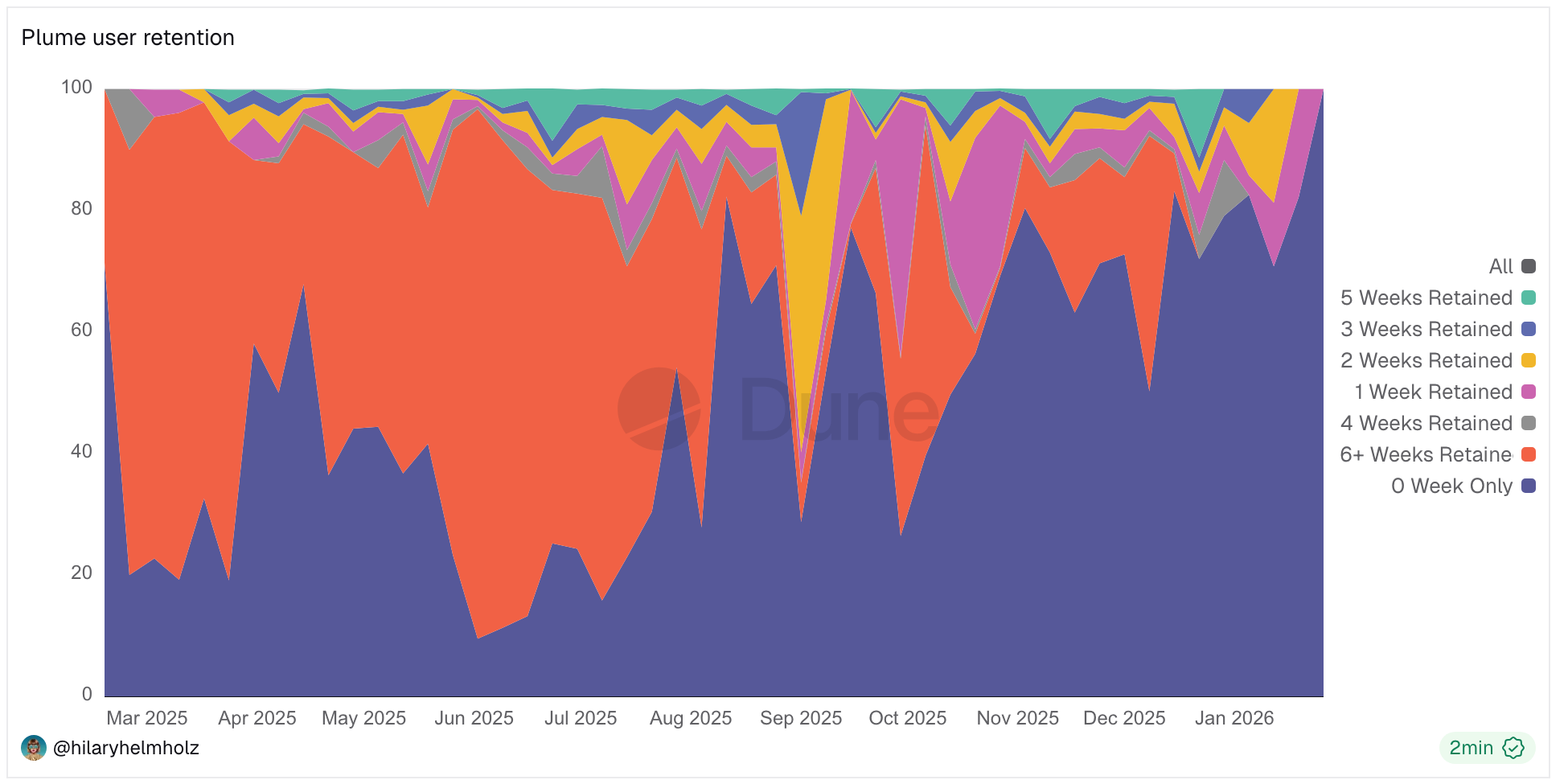

Plume had a successful track record of retaining users before announcing its mainnet launch and Tron integration, providing a secure launching pad to onboard new users. The below charts illustrate 7 and 30 day Daily Average User (DAU) and Plume network user retention as a share of total users.

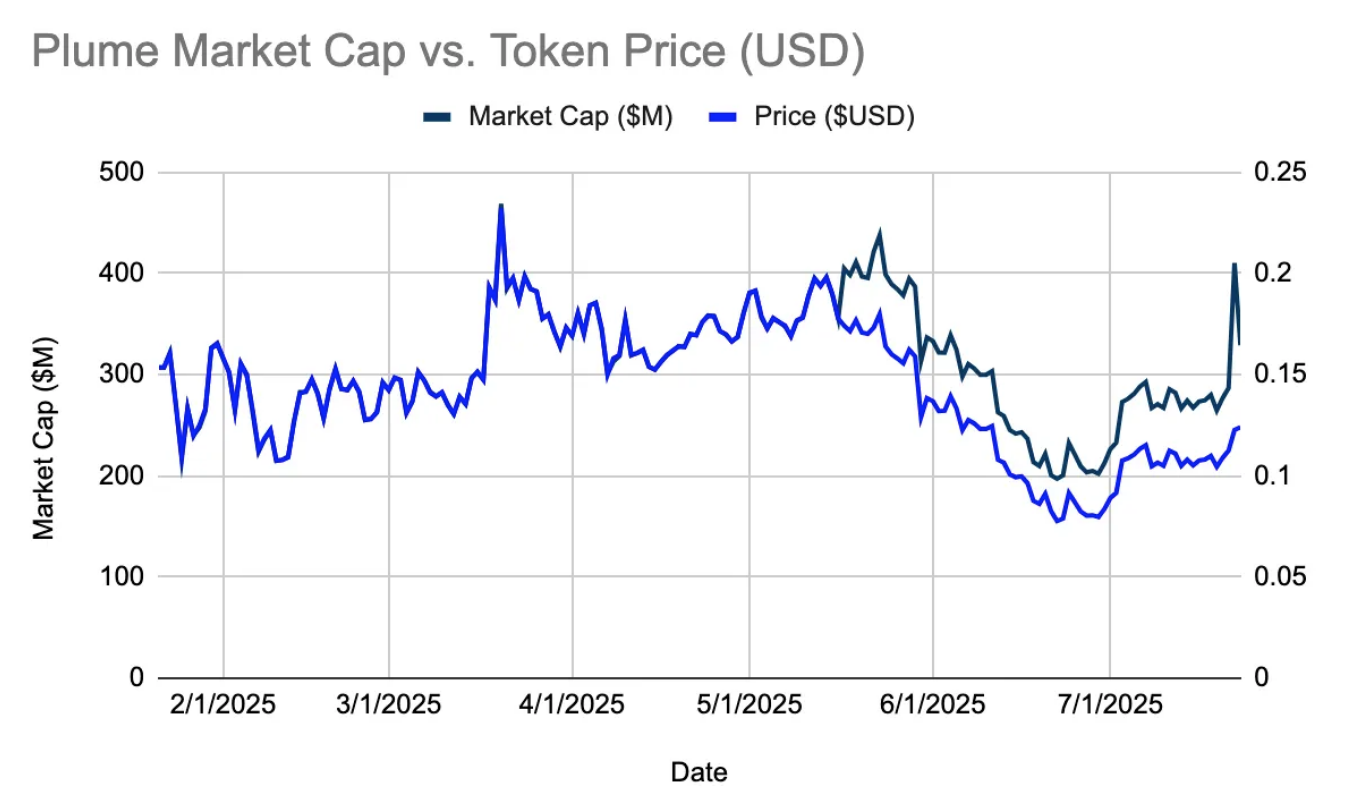

Even with smart alignment of airdrops to product releases, reviewing Plume’s token price and market cap history illustrates that importance of using tokenomics strategically as supply is added to the market. See the below chart.

While it is tempting to treat airdrops as part of a marketing strategy, they are actually a fusion of capex, opex, and capital allocation, which has the power to coordinate supply and demand. They require intelligent execution timing, and infrastructure. Done well, they bootstrap the community, align incentives, and accelerate protocol growth.