Affordable Housing Security Token Case Study

Originally published on Medium, 7/10/2025.

An affordable housing foundation was preparing to raise a tokenized real estate fund and was evaluating several financing options, ranging from pure equity token sales to a hybrid approach involving both debt and equity through token generation events (TGEs). The key questions were: how much capital should be raised to sustainably cover annual operating costs at scale, and whether it would be more effective to raise the full amount upfront or conduct recurring annual TGEs.

The foundation estimated its total yearly operating costs could be capped at $2.5 million and aimed to generate a net income of at least $1 million annually to reinvest into the fund.

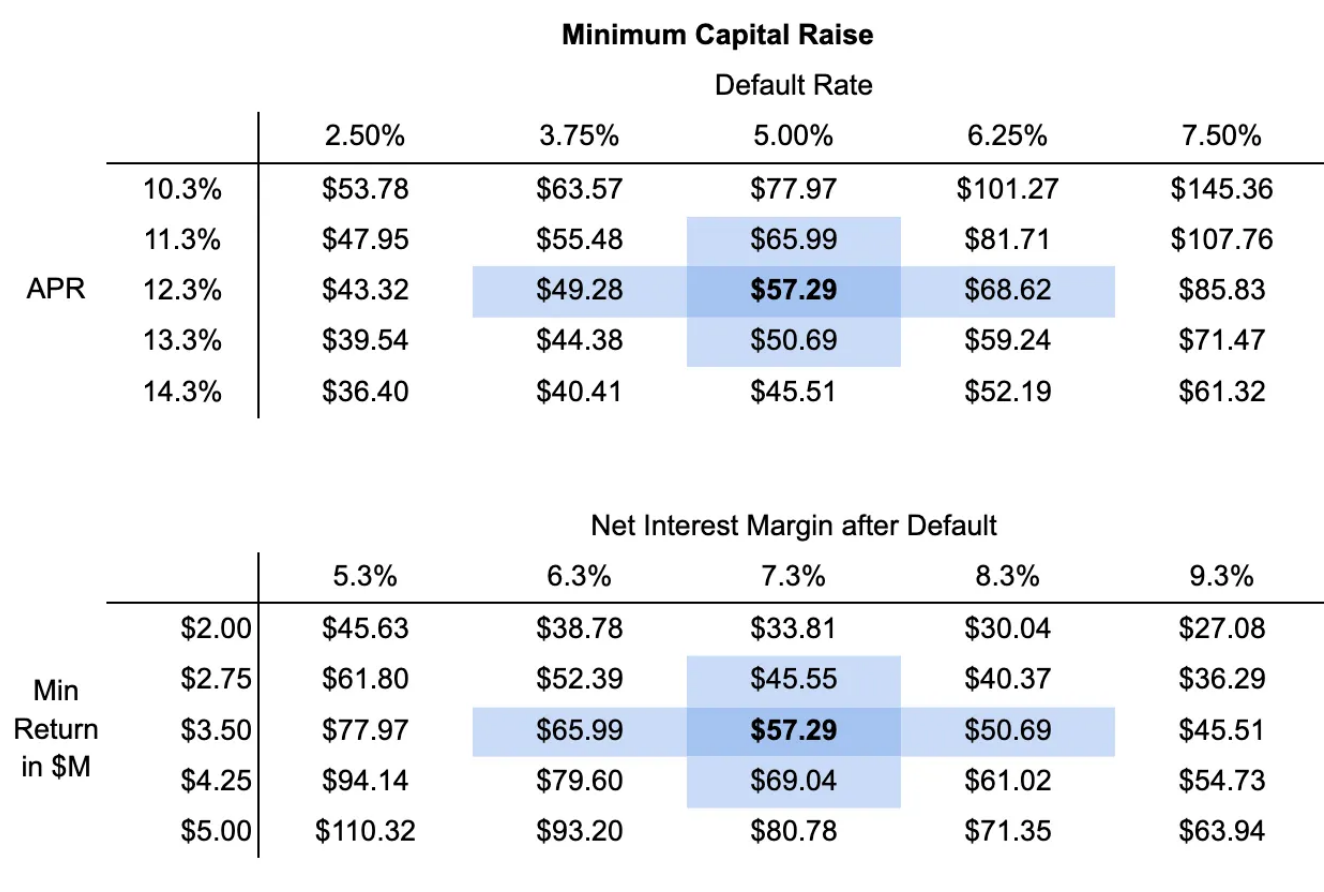

A sensitivity analysis was conducted to determine the target capital raise required to yield $3.5 million in annual income, while also allocating 5% of the initial raise to a token liquidity pool. Based on this analysis, multiple capital raise scenarios were modeled.

The resulting recommendation was a minimum capital raise in the range of $45 million to $70 million, with a target of $57 million.

Please note: numbers displayed are shown for informational purposes and do not represent the client’s final numbers used for fundraising.