Reimagining Maps through Blockchain Incentives — The Hivemapper Story

This article was originally published on Medium on 10/2/2025

Hivemapper is building the world’s most dynamic, decentralized mapping network by leveraging blockchain incentives and community participation. Using proprietary dashcams and a tokenized reward system (HONEY), contributors continuously capture and validate street-level imagery, producing fresher and more accurate maps in more cost-effectively than traditional alternatives.

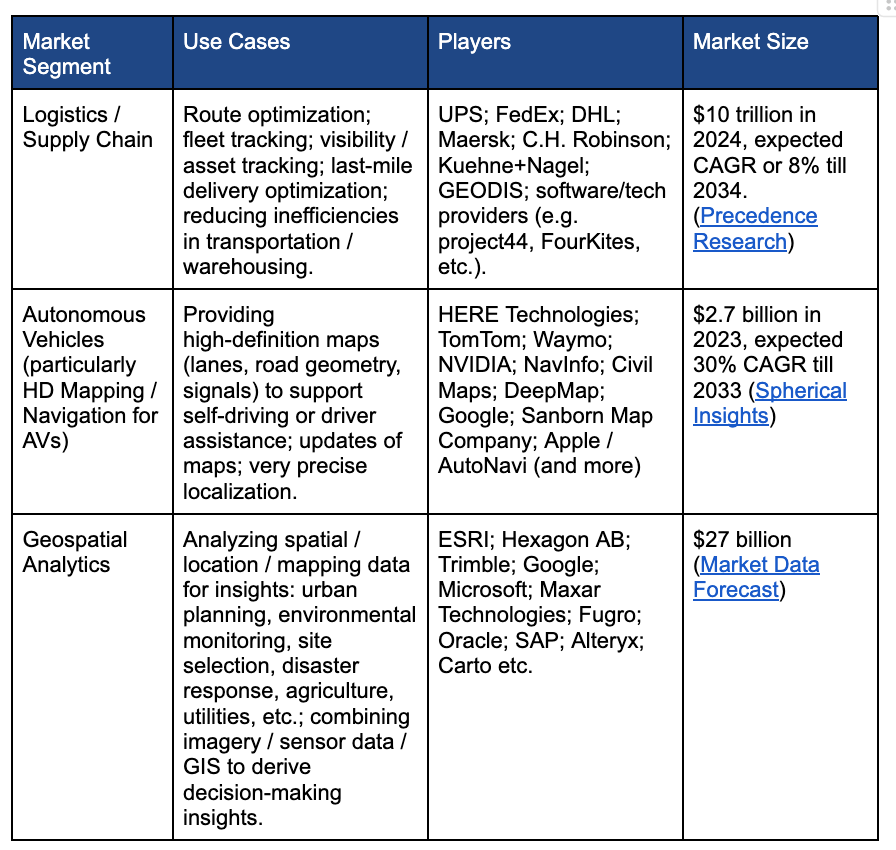

The mapping and geospatial services markets together exceed $100 billion annually (Verified Market Reports and Verified Market Research), underpinning industries such as logistics/supply chain, autonomous vehicles, and geospatial analytics, all of which have a combined market size of over $10 trillion (see Navigating the Market). With demand for high-frequency, real-time mapping increasing, Hivemapper is uniquely positioned to disrupt a market historically monopolized by a few large players. Its decentralized physical infrastructure (DePIN) model reduces mapping costs, expands coverage, and aligns incentives across contributors, enterprises, and token holders.

Since launching in November 2022, the Hivemapper Network has achieved rapid growth. By July 2023, the network had mapped over 3.6 million unique kilometers of roads, an achievement that took Google Maps more than a decade to reach (VanEck). At the time of writing Hivemapper has mapped more than 21 million unique kilometers or 35% of global road coverage (Hivemapper).

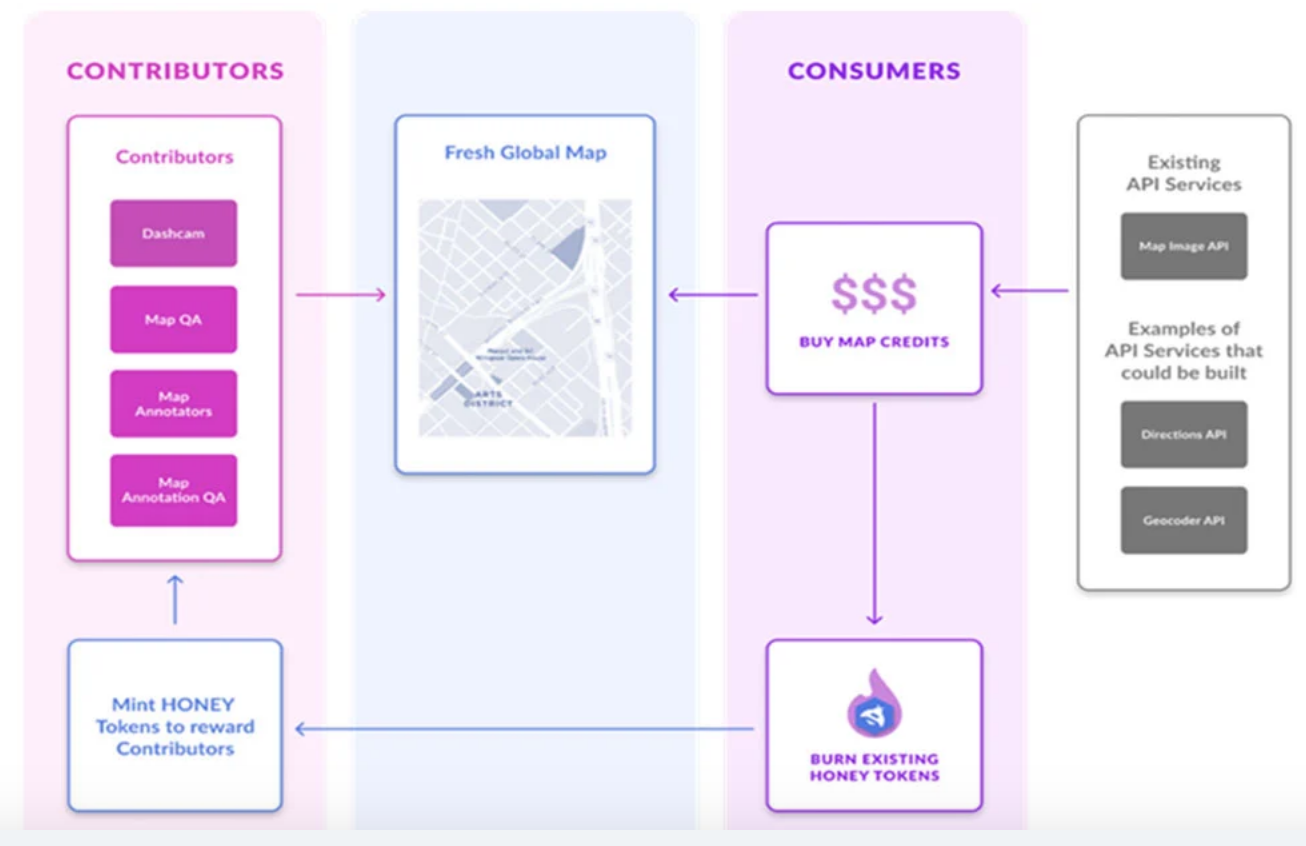

The network’s tokenomics model balances supply and demand through a burn-and-mint mechanism: contributors are rewarded in tokens for generating data, while enterprise customers purchase access to map features and imagery, driving token burns to sustain long-term equilibrium.

Assuming market conditions remain stable, Hivemapper’s current earnings trajectory and declining token issuance suggest near-term appreciation potential for HONEY. Based on current earnings multiples, prices are expected to range between $0.014 and $0.019 over the next several months as revenues increase and post-unlock selling pressure subsides. Over the longer term, as Hivemapper expands its market share within the $100 billion mapping and geospatial services sector, the token could reach a conservative target of $0.10, driven by both network growth and the protocol’s deflationary burn mechanics. This outlook reflects a gradual transition from growth funded by token issuance to a model sustained by recurring enterprise demand and rising token scarcity.

Charting the Beginning

Founded in 2015 by Ariel Seidman and Ben Wong, with the goal of creating the world’s most up-to-date map using drones, Hivemapper later pivoted to dash cams powered by blockchain payments. This shift was enabled by crypto, which allowed rewards to be distributed directly among contributors.

In November 2022, the company launched the Hivemapper Network: a user-driven global mapping network built on the Solana blockchain. Hivemapper’s suppliers, dashcam holders, capture street-level imagery with the help of the company’s tailor-made dash cams. Drivers receive the native HONEY token to incentivize data collection as they drive.

Hivemapper turns the crowdsourced data into a world map that is constantly expanding and updating via fresh data provided daily by active drivers . Network participants can also earn tokens for providing quality assurance checks on routes mapped by others. In April, Hivemapper launched a simple game designed to help train map AI to better recognize objects within images, which provides another avenue for users to earn tokens (Solana).

Inside the Hive: The Product Suite

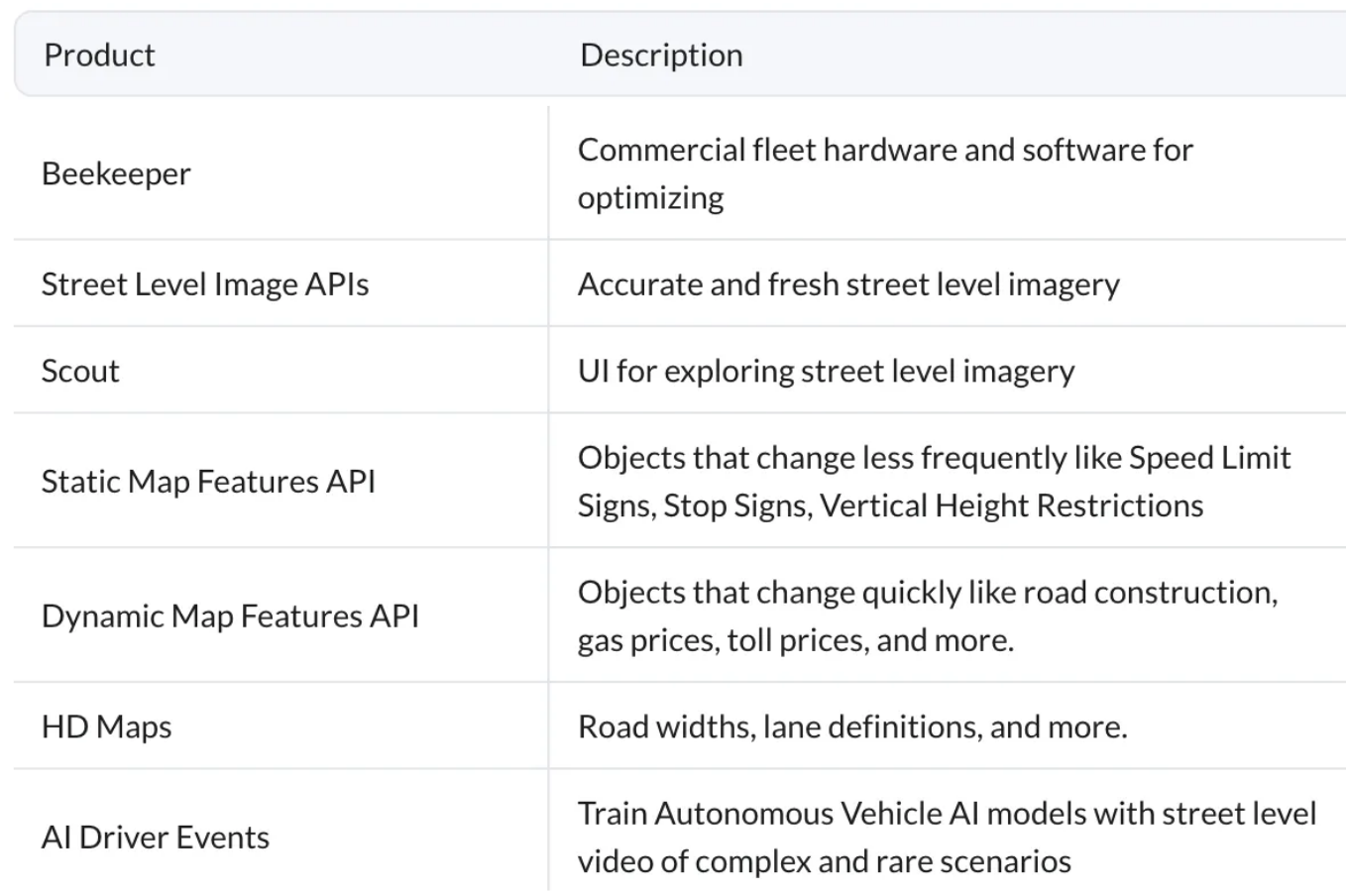

Hivemapper Dashcams record a rich amount of data which enables Hivemapper to offer products running from HD maps, fleet optimization, and street-level Image APIs. See full product list and description below:

A customer purchases Hivemapper Map API services with map credits priced in fiat at $0.02/map credit. Fifty map credits equals $1.00 to provide access to 1 kilometer worth of map data. If one were to purchase Hivemapper’s map of New York City, it would cost 7.8 million map credits or $156k.

The customer must first purchase map credits, then an equal amount of HONEY tokens are burned when the map is purchased. The burned tokens are then reallocated toward a new rewards pool for contributors. This burn and mint mechanism ensures the supply of HONEY does not exceed 10 billion tokens (VanEck). See Tokenomics: Incentives and Opportunities for more about Hivemapper’s Tokenomic ecosystem.

At Hivemapper’s direct competitor, Google, maps are priced per load and are calculated using an average monthly usage with different price tiers based on map complexity. This pricing favors high usage customers with large budgets versus a one time purchase. Cost increases as map information and complexity increase (Google).

Navigating the Market

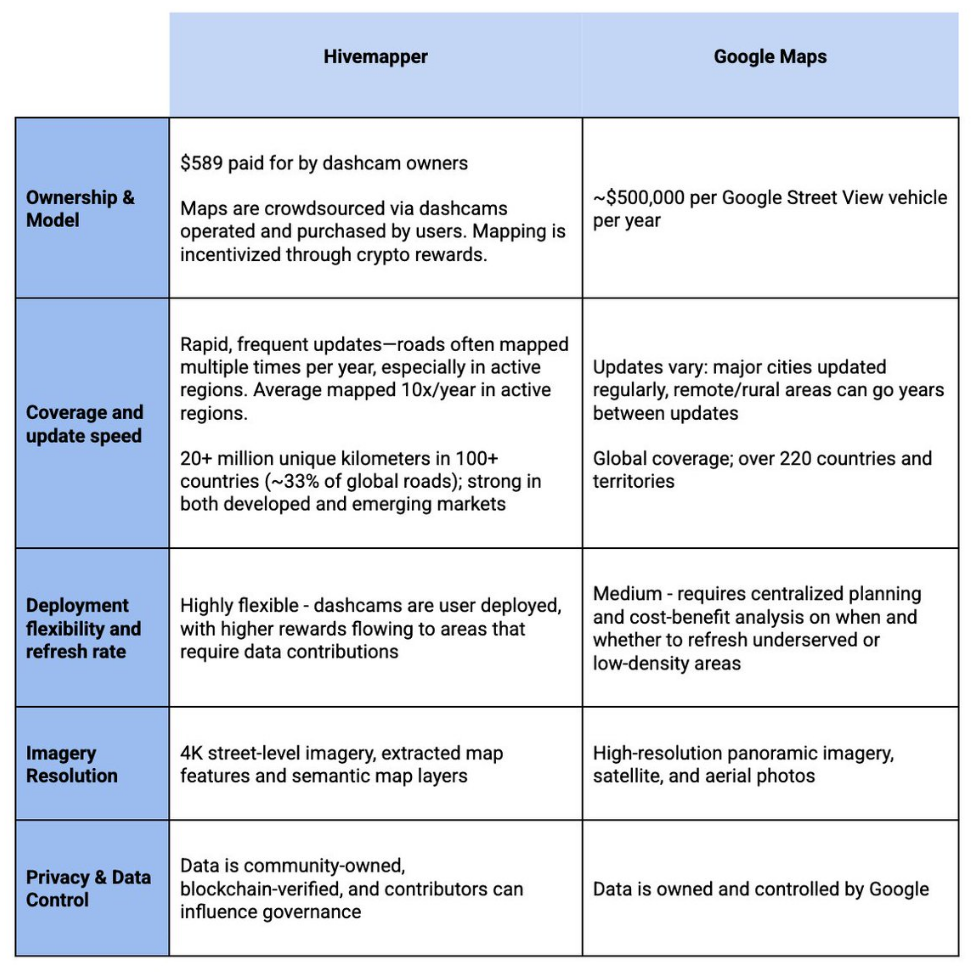

Before Hivemapper, the mapping industry was dominated by a few key players. Google maps pays about $500k annually per car for mapping data, resulting in maps that lack freshness (VanEck). After the car records a street, it then takes a few months to over a year for that imagery to be processed and uploaded (Google Support). As Hivemapper’s maps are crowdsourced and paid for by its own native token, up front cash costs are distributed among a network of contributors. At the time of writing, Hivemapper counted over 165k contributors distributed globally. (Hivemapper) A flexible network means that Hivemapper can incentivize mapping for on-demand updates as needed by customers. The below table illustrates the operational mapping differences between Hivemapper and its closest competitor, Google Maps.

Like many DePIN networks, Hivemapper faces competition from the well-funded sales teams of large tech companies (VanEck). In some of Hivemapper’s direct competitors such as Google, maps are additional features that drive traffic to a core product rather than a core competency. Instead of positioning itself purely as a rival, Hivemapper can collaborate with incumbents by providing fresher data or coverage in regions where traditional mapping methods are too costly.

A strong example is its partnership with Netherlands-based HERE, a leading provider of mapping services to automakers, e-commerce, transportation, and logistics companies worldwide. The collaboration began in late 2022, when HERE sought high-quality street-level imagery. After a successful pilot, HERE increased its purchases of Hivemapper data tenfold in 2023. (Hivemapper)

Mapping the Opportunity: The Road Ahead

Traditional mapping faces key challenges: uneven coverage and freshness, limited suitability for autonomous driving, high costs due to a small number of providers, and inconsistent data quality. Hivemapper’s model directly addresses these pain points.

Estimates for the mapping and spatial data market exceed $100 billion annually, however, the mapping and spatial data market underpin or feed data into various other markets running from supply chain and logistics to autonomous driving, with a total combined market size exceeding $10 trillion. See below chart for details of the various markets and use cases that Hivemapper’s current product offering supports.

By addressing the challenge of map freshness, Hivemapper is expanding both use cases and potential clients. Its unique, decentralized data-gathering process not only keeps maps up to date but also provides a greater level of street-level detail and critical context, helping customers understand the “why” behind changes in traffic patterns and travel times.

For example, users and AI systems guiding users can determine whether slowdowns are caused by a crash that will clear in hours or construction that may last for weeks. (VanEck) These insights are supported by up-to-date image confirmations instead of user reporting currently utilized by some of Hivemapper’s closest competitors. Logistics companies may want to have visuals of loading docks and parking restrictions before delivery, as knowing can save them time and money. In addition to enterprise use cases, governments want to know where road maintenance is necessary, have traffic intelligence, or the fastest routes available for emergency response times. (VanEck)

Typical of most startups Hivemapper’s is building capacity and product functionality to accelerate revenues. Network trailing 12-month revenues of $644k (Dune) only represent a small portion of the market, but Hivemapper’s global reach and product portfolio is setting up the network for success.

Tokenomics: Incentives and Opportunities

HONEY is the backbone of the Hivemapper ecosystem, mediating map demand and supply through a closed-loop incentive model that aligns contributors, customers, and long-term network sustainability (VanEck). For more details on how HONEY facilitates map purchases, see the Products section.

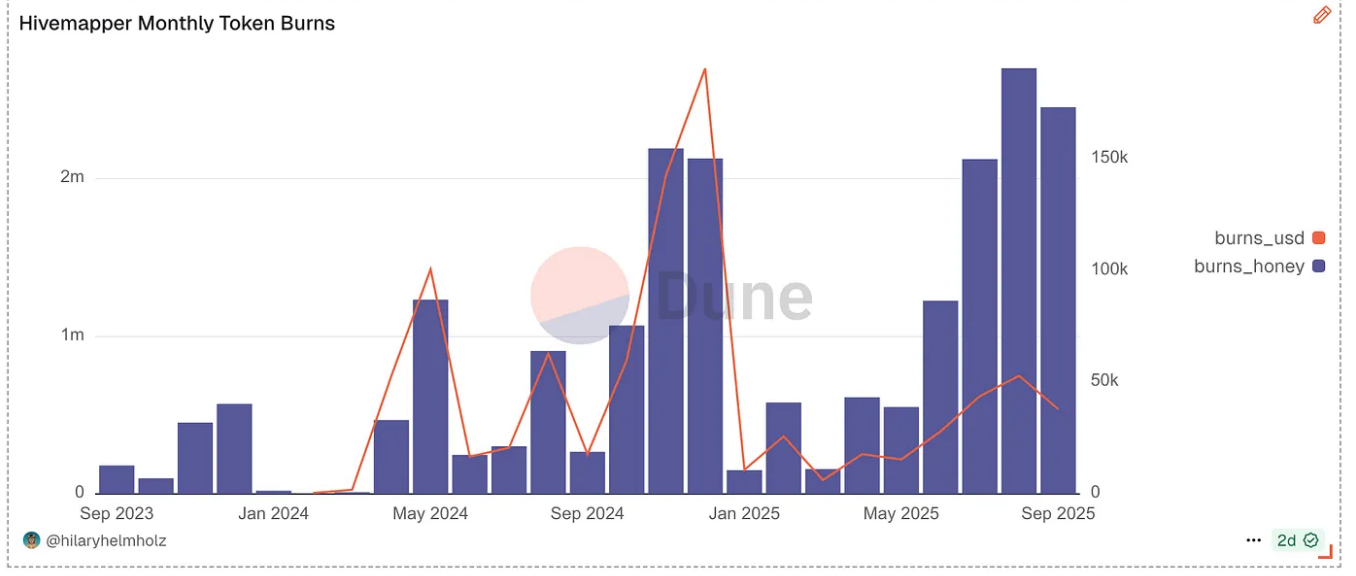

Every HONEY token that is burned represents its conversion to map credits. Month-to-month demand has been mixed. In Hivemapper’s mint and burn policy, decreasing token prices increase token burns, eventually providing deflationary pressure on the token. Given that 75% of token burns are permanent (Hivemapper), weak token prices will accelerate long-term deflationary pressure.

HONEY has a fixed maximum supply of 10 billion tokens, allocated as follows:

40% — Contributor rewards (map data collection, AI training, validation)

20% — Investors (early capital)

20% — Employees (team incentives)

15% — Hivemapper Inc. (R&D and operations)

5% — Hivemapper Foundation (ecosystem growth and management) (Hivemapper)

As of this writing, roughly 70% of the total supply has been minted (CoinMarketCap). Notably, the 40% of tokens allocated to investors and team members were minted within the first 36 months of protocol operations. Investor and Employee stakeholders faced a 12-month lockup before monthly tranche unlocks began. Investor unlocks occurred over 24 months, with full vesting completed on November 3, 2024, while team member unlocks extend across 36 months, ending on November 3, 2025.

If the network progresses at maximum speed, it would take roughly 10 years to mint 4 billion HONEY for contributors. Over time, token emissions are balanced by demand-driven burns, creating a self-sustaining economic flywheel (Hivemapper).

Value Creation vs. Token Supply

For token prices to remain stable, or rise, relative to minting schedules, a protocol must generate recurring revenues that translate into sustained demand for the token. In other words, ecosystem utility and value creation must at least keep pace with new issuance. Unlike traditional VC models, Web3 introduces earlier liquidity that is shared between contributors and investors. Looking at the price performance chart in the Valuation section, it is evident that Hivemapper’s pace of value creation lagged behind the rate of token mints and unlocks.

That said, contributor minting directly funds network growth. As map coverage expands, ecosystem value should increase (See more about Airdrops here). A further layer of complexity lies in stakeholder behavior: the more tokens that long-term holders (contributors, team, or investors) retain, the less room remains for bearish selling pressure, giving bullish market participants greater influence in setting prices. (Greenwood)

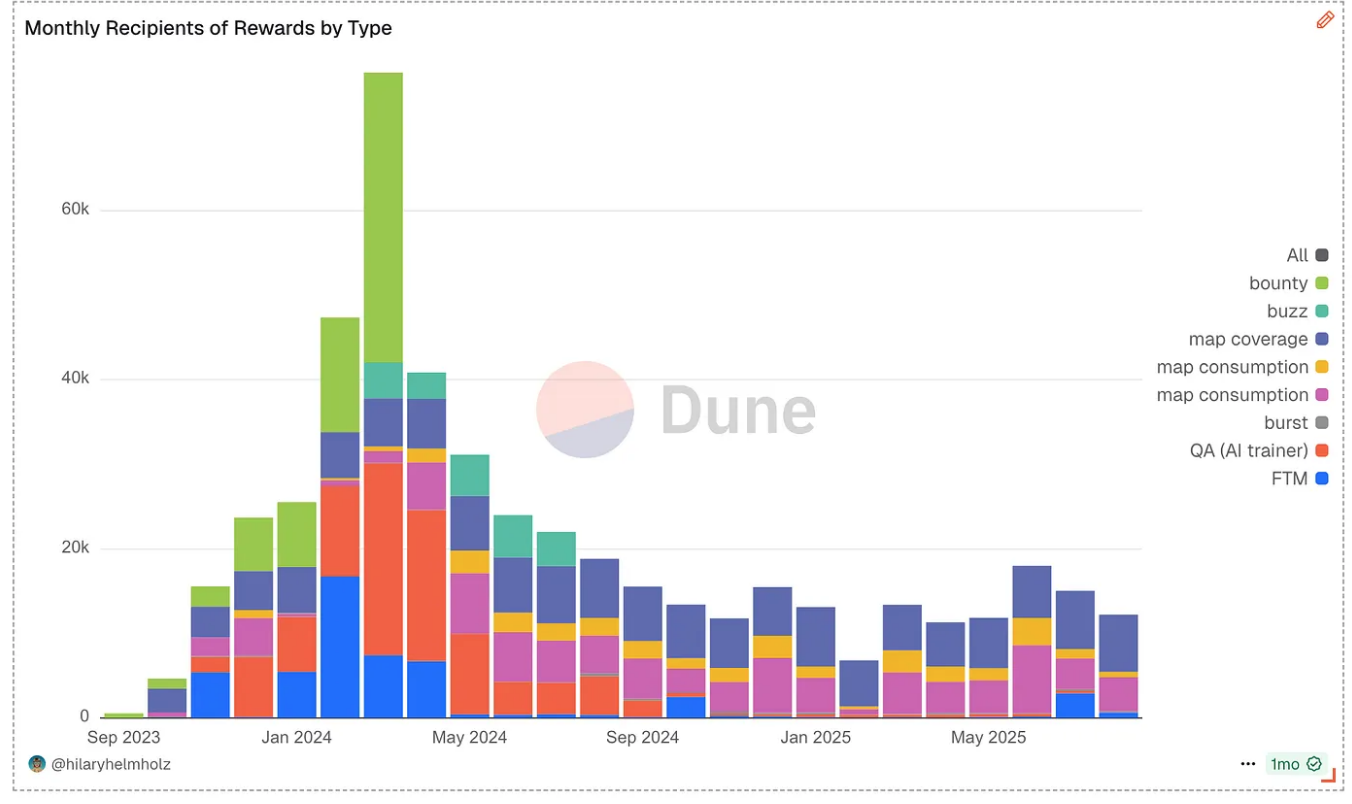

Dynamic Reward Calculations

Hivemapper’s contributor rewards are structured to scale with the network while ensuring quality, breadth, and long-term sustainability. Distributed weekly, rewards follow the Global Map Progress Model, which allocates incentives based on coverage (60%), activity (30%), and resilience (10%). This framework prioritizes expanding global road coverage, sustaining contributor participation, and maintaining a diverse contributor base that prevents concentration risk. Importantly, regions with higher commercial demand or faster growth receive heavier weighting, ensuring that resources flow where customers derive the most value. For investors, this dynamic allocation is not just a technical design, it is a growth lever that channels token emissions into the highest-value areas, reinforcing Hivemapper’s competitive edge in freshness and relevance.

Beyond the base model, Hivemapper incorporates additional mechanisms to strengthen quality and efficiency. Reputation scores tie contributor earnings to accuracy, discouraging low-value submissions, while AI trainer rewards incentivize labeling and validation that enhance the platform’s machine learning models. Under-mapped regions benefit from saturation-based rewards, reducing redundancy and driving global expansion, while the tile freshness multiplier resets each map tile’s reward after it is captured, replenishing over time to encourage continual updates. These refinements ensure that contributors remain motivated to produce high-quality, commercially valuable data, while investors can view the system as a self-correcting flywheel that directs token emissions where they maximize network utility. By combining economic alignment with operational precision, Hivemapper’s reward system transforms short-term contributor incentives into long-term value creation. See more details at Hivemapper.

Monthly rewards for contributors are broken down in the following graph.

From Data to Dollars: Assessing the Value Proposition

At the time of writing the HONEY token had a market cap of $72.29M and FDV of $153.03M trading around $0.015 (CoinMarketCap).

Like all web3 protocols, the token has seen high pricing volatility as it establishes its business. Minting tokens to reward investors and team members has depressed the token price with additional supply that has come in advance of substantial revenues that will support the ecosystem. The last mint for team members will be this November 2025. Investors should start to see meaningful price appreciation as new token minting tapers down and deflationary burns start to pick up.

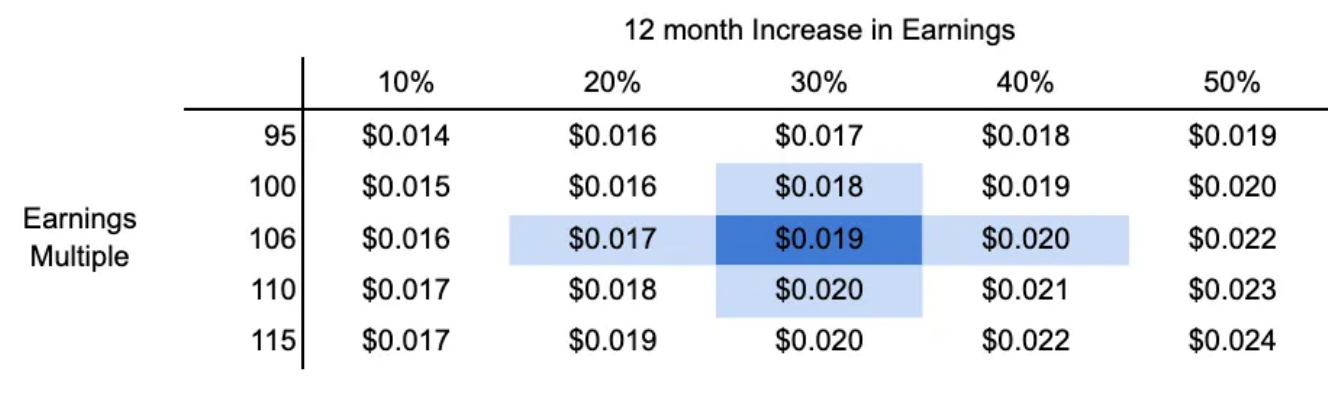

In crypto broadly, protocol earnings multiples have not normalized to provide investors with clear trends. Estimating forward 12-month earnings of approximately $700k means that HONEY currently trades at a 106x multiple. This may seem high for investors used to P/E multiples of web2 and established companies, however this is within a reasonable range seen in my tokenomics practice where multiples have ranged from 0x — 1,000x since 2022. DePIN VC investor, Ev3, has found that DePIN multiples are highly correlated to listings on larger exchanges; HONEY is available to trade on all major CEXs and DEXs (Ev3). Hivemapper’s token is widely available, meaning it can trade at a premium.

Maintaining an earnings multiple of 106x, any protocol earnings gains would lead to a corresponding increase in token price. The below chart shows various potential token prices with their corresponding earnings multiple and protocol earnings increases.

DePIN market multiples can be volatile and short lived. Please do your own research before investing.

Earnings multiples aside, performing a simplistic forward looking analysis: if the Geospatial market TAM stays flat at $100 billion and Hivemapper captures 1% of the market, HONEY could be conservatively valued at $0.10 per token. This assumption hinges on a direct correlation with market share and token market cap. The valuation considers all tokens have been minted but does not account for deflationary mechanisms or earning multiples. Since the protocol permanently burns 75% of the tokens burned for map services, growing market share and map demand will put deflationary pressure on tokens as the protocol matures, which could push prices above $0.10 long term.

Given where Hivemapper is in its cycle, token price appreciation in the near term is most likely to come from increasing revenues via gaining current market share, launching new products. As outstanding tokens approaches its 10 billion cap, participants should start to see the effects of the deflationary burn of 75% of revenue.

Charting the Future

Hivemapper’s decentralized approach to mapping has the potential to unlock significant long-term value by transforming how spatial data is created, distributed, and consumed. By shifting the cost of data collection away from a handful of incumbents and toward a globally distributed contributor base, the network delivers fresher and more comprehensive coverage at a fraction of traditional costs. This model not only expands the addressable market by enabling new use cases — such as high-frequency updates for logistics, autonomous vehicles, and urban planning — but also aligns incentives across contributors, customers, and token holders through its burn-and-mint mechanism. Each incremental improvement in coverage or freshness compounds the value of the overall dataset, creating a flywheel that grows stronger as adoption increases.

While early revenues remain modest relative to the scale of its ambition, the foundation Hivemapper has built, a rapidly growing contributor network, enterprise traction, and a tokenomics system that introduces deflationary pressure over time, set the stage for exponential value creation. If Hivemapper succeeds in capturing even a small fraction of the multi-trillion-dollar industries that rely on accurate, dynamic maps, it will not only validate the DePIN model but also demonstrate how blockchain incentives can reconfigure entrenched markets. In this sense, Hivemapper is more than a mapping company; it is a proof point for how decentralized infrastructure can generate durable economic and societal value.

Short term Hivemapper’s token price is expected to correlate strongly to protocol earnings, with an eye for longer term investment there is significant opportunity as Hivemapper gains market share and expands product offerings.