From Hype to Fundamentals: A Case Study of Helium & DePIN

Originally published privately, then on Medium. This case study was updated on 12/17/2025 to incorporate current up to date information about Helium’s tokenomics and its development. Selected graphs and charts were updated on 1/30/2026 when this case study was imported from Medium. A special thanks to the Helium community for their time and assistance

Crypto and web3 broadly is often criticized for its volatile price movements across bull and bear markets that are difficult to attribute to clear fundamentals, as many assets trade on sentiment rather than on intrinsic value. DePIN, Decentralized Physical Infrastructure Networks, however, offers a distinct category where network, financial and product fundamentals provide a clearer basis for analysis and valuation.

DePIN protocols leverage blockchain infrastructure to coordinate physical-world infrastructure deployment via tokenized incentives and decentralized governance. Conceptually, DePIN can be understood as a crypto-native evolution of two-sided marketplaces, similar to how platforms like Uber and Airbnb aligned fragmented supply with demand through centralized coordination. In contrast, DePIN protocols create multi-sided marketplaces with coordination enforced via cryptographic consensus, enabling permissionless participation in infrastructure development.

From decentralized wireless (e.g., Helium) to distributed GPU compute (e.g., io.net), DePIN networks bootstrap supply from independent operators, minimizing upfront capital expenditure and enabling rapid network effects. These protocols act as autonomous coordinators, matching supply and demand while abstracting away trust through smart contracts and transparent economic incentives.

This architecture creates new market opportunities by:

Bootstrapping supply in advance of demand to test market fit

Serving highly localized or under addressed demand (e.g., mesh networks, geospatial data, or decentralized storage)

Aggregating idle capacity (e.g., GPUs, sensors, bandwidth) into scalable services

While the cryptographic foundations of DePIN protocols introduce technical complexity, their core structure still aligns with traditional business and economic principles. Founders and investors can apply familiar valuation tools, such as cash flow modeling, capex/opex analysis, and cost-to-serve benchmarks, alongside tokenomics-specific frameworks. The value of this exercise extends beyond arriving at a token and company valuation. It sharpens strategic thinking, highlights operational trade-offs, and surfaces market opportunities. By grounding decisions in structured analysis, founders and investors are better positioned to avoid costly missteps and to create a nimble and resilient operating structure.

The DePIN Corporate Structure — Where to Invest

The typical structure includes a Lab, often a for-profit entity that performs research and development and holds the intellectual property, and a foundation, usually a non-profit that manages governance and ecosystem development of the protocol or transaction layer. The token minted by the protocol is used to facilitate network transactions. Depending on how the protocol was built, token ownership represents, at minimum, a stake in the network itself and potentially allows for voting in how the protocol is governed. Investors can gain exposure to the protocol by purchasing tokens or by investing in the Lab or both. Equity investment in the Lab gives investors access to the IP as well as potential revenue flows from the foundation.

Closed vs. Open Networks

Open networks are valued for their independence from centralized control, allowing developers to build on the platform without reliance on a single entity. In contrast, closed protocols can offer greater value when a dedicated team is able to execute and scale more efficiently than an open-source alternative. In such cases, token investments are typically considered subordinate to equity, as lab shareholders have greater influence over how value is distributed (Ev3).

As of Q1 2025, there is no clear consensus on valuation multiples for DePIN tokens. Even among networks offering similar products or services, multiples can range widely, from 2x to 100x. Further complicating matters, token prices are often influenced by the exchanges on which they are listed (Ev3). In such a fragmented and uncertain market, conducting thorough due diligence to understand business fundamentals and intrinsic value is essential.

The Helium Network

Among early DePIN protocols, Helium stands as one of the most ambitious and instructive examples. The Helium Foundation, which governs the Helium Network, is categorized as a 501(c) non profit with Nova Labs as a steering member. Through the Helium Network, Nova Labs has developed a decentralized, crowdsourced infrastructure network underpinned by a cryptographically secured transaction layer for deploying products and services.

Originally launched as a decentralized wireless network for Internet of Things (IoT) connectivity, Helium pioneered the use of token incentives to bootstrap physical infrastructure at a global scale. Its trajectory, including early growth, token economics, challenges with demand generation, and a recent pivot toward 5G under the Helium Mobile brand, offers critical insights into both the potential of the DePIN model and the consequences of an underdeveloped early-stage strategy.

By leveraging tokenized incentives, Helium distributes both capital expenditures and operational costs, creating a permissionless, community-powered alternative to traditional telecom infrastructure. Founded in 2013 by Amir Haleem, Shawn Fanning, and Sean Carey, Helium set out to build a decentralized wireless network tailored for low-bandwidth, low-power Internet of Things (IoT) devices. Its first seed round was announced in November 2013, and after several years of development, the network officially launched with an ICO in 2019, alongside its first flagship product: The Helium Hotspot. This physical device allowed anyone to contribute to the network by providing wireless coverage for IoT devices and earning tokens in return (Helium). As part of its 2022 capital raise, Helium Inc. was rebranded to Nova Labs to separate the operating company from the protocol network (Coindesk).

The network’s architecture includes subnetworks that use Proof of Coverage (PoC), a novel consensus mechanism that verifies physical location and uptime of hotspots as a basis for rewards. Initially launched on its own proprietary blockchain, Helium transitioned to the Solana blockchain in April 2023 to support greater scalability and throughput (Helium).

To use the Helium network, a customer must first purchase the network token, HNT, which is then converted into data credits (DCs) at a fixed rate of $0.00001 per 24 bytes of data. While the cost of data is fixed in USD; the price of HNT fluctuates based on network demand. (Helium Whitepaper). A standard SMS message will use about 160 bytes, which has a cost of 6.7 DCs or approximately $0.0007 (Textline). Under this pricing, low and medium usage IoT devices would have a monthly cost of $0.2 to $41 for 500KB to 100 MB of data.

The Helium network generates revenues in the form of Data Credits for IoT and mobile services in addition to fees for hotspot set up (Fortune Crypto). While the economic relationship between the Helium Network and Nova Labs isn’t publicly disclosed, CEO Amir Haleem stated that Nova Labs earned about 1.5M HNT from the Helium Network as of July 2022 (X.com). At that time Helium network was generating around $2M per month mostly in hotspot set up and $6,500 monthly in data transfers.

September 2022, Nova Labs announced a partnership with T-Mobile to provide mobile coverage directly to consumers, branded as Helium Mobile. After a beta phase, a pilot program was rolled out in Miami in 2023, and mobile hotspots were launched in October. Service expanded to Mexico with a Telefonica partnership in 2024 (Helium). As of 2024, Helium network usage for mobile had surpassed that of IoT (Messari).

Decentralized Trust & Value Exchange

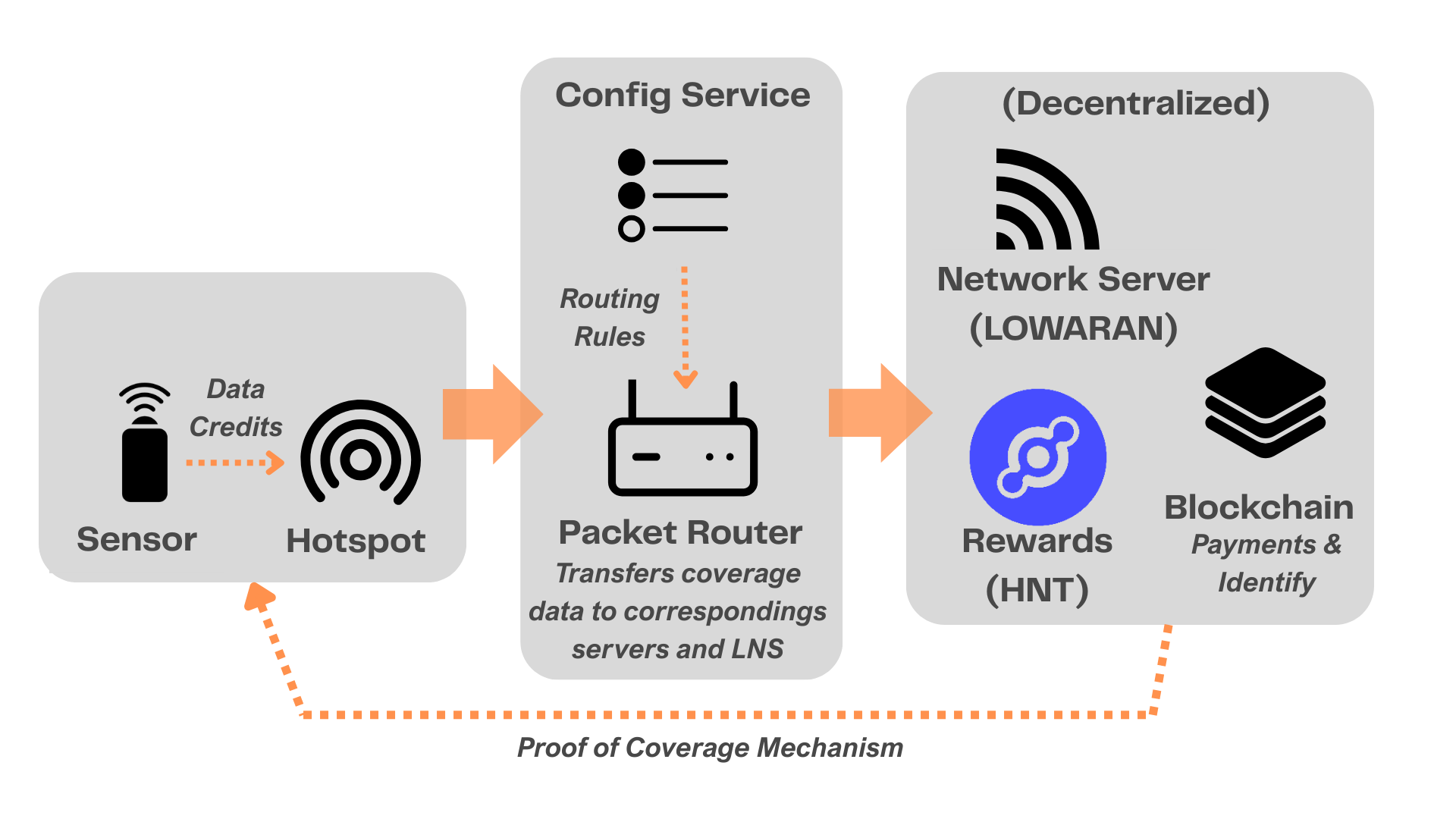

The Helium network functions through a unique decentralized wireless protocol called WHIP, which facilitates data transfer between IoT devices and the internet without relying on a central authority. Per Helium’s whitepaper the WHIP: “provides a bi-directional data transfer system between wireless Devices and the Internet via a network of independent providers that does not rely on a single coordinator, where: (1) Devices pay to send & receive data to the Internet and geolocate themselves, (2) Miners earn tokens for providing network coverage, and (3) Miners earn fees from transactions, and for validating the integrity of the Helium network” (Helium Whitepaper). See the following diagram for a visual illustration of how the IoT network operates.

Helium via Messari. Icons by Abdul Matic, Raunak Dutta, INA, UNKNOWN, Lukman Hakim via the Nount Project

See here for a more detailed description of the network architecture.

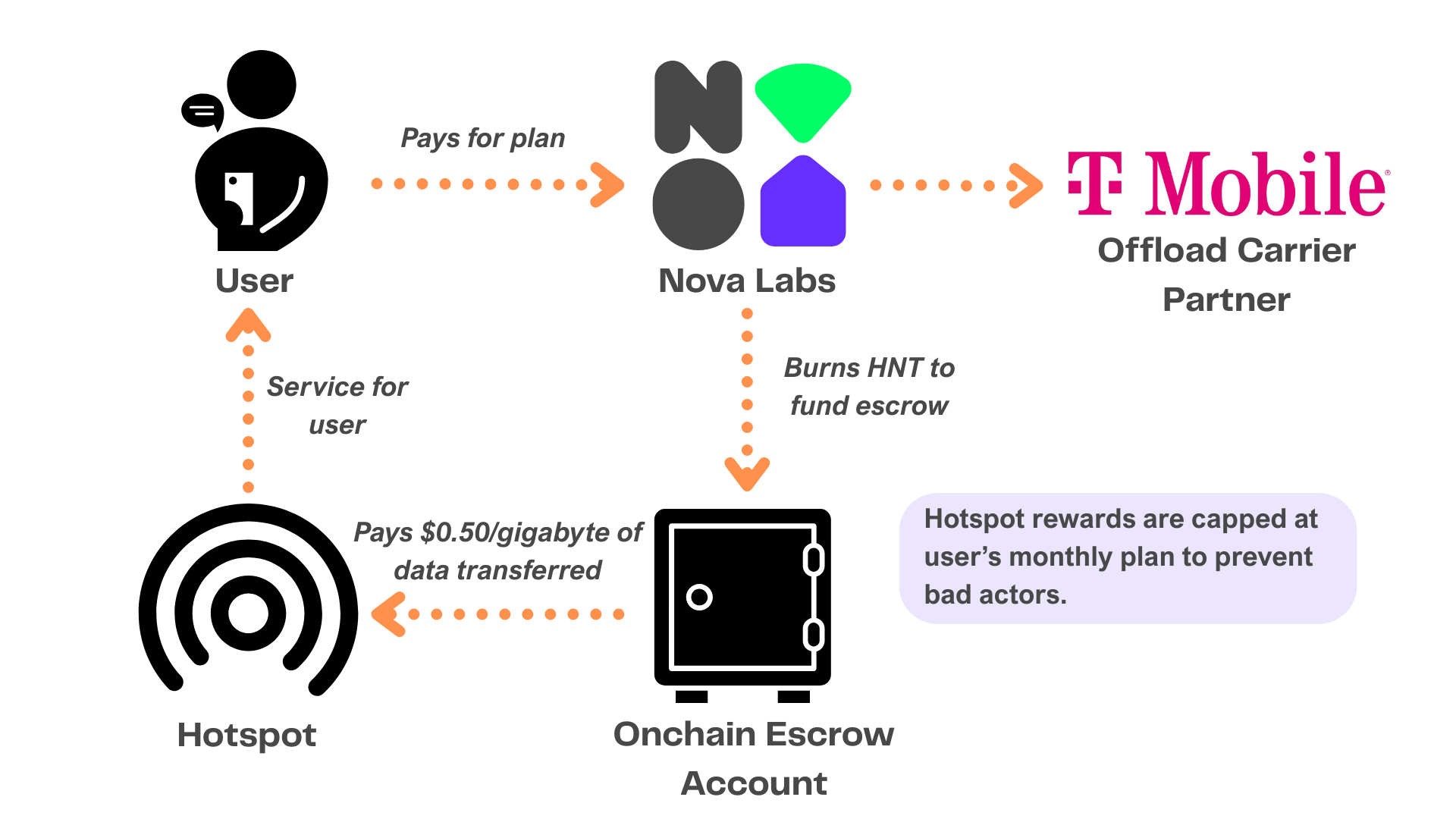

As of October 2023, Nova Labs has been operating a Helium-branded, decentralized, direct-to-consumer mobile network. The network is built on Helium Mobile hotspots and uses T-Mobile as an offload partner. Hotspot rewards follow a structure similar to Helium’s IoT network, as shown above. See the diagram below for operational details of the mobile plan.

Diagram: Helium via Messari. Icons by Lukman Hakim, NAPISAH, Nur Faizah via the Noun Project

Early Issues

Helium’s rapid early IoT growth was driven by generous token incentives and retail enthusiasm for crypto. Early adopters received income from setting up hotspots, however demand and payment for IoT connectivity was not enough to support market supply provided by Helium and the inflated values of a bull crypto market. (Liron Shapira, X.com) As founder and CEO, Amir Haleem, noted, IoT networks have a chicken and egg issue. Building a network to support a robust app experience is not feasible for companies until there is strong market demand, but market demand will only be created once there is a viable network to build on (X.com). [See more in Market Opportunities: IoT.]

Via the Helium Network, Nova Labs has been repositioning itself not only as an operator of Helium Mobile (its consumer-facing 5G product), but also as a potential infrastructure layer for other DePIN protocols to build on. This pivot reflects a broader ambition to transition Helium from a niche wireless network into a general-purpose, decentralized infrastructure layer. (Messari)

Network Design: Incentives & Coordination

When evaluating DePIN protocols, analyzing network design is as critical as evaluating operations in a traditional company. The physical and logistical components of deployment, hardware, supply-side onboarding, geographic coverage, sales channels, and trust mechanisms, directly influence a network’s scalability and long-term viability.

Hardware Considerations

Many DePIN protocols, including Helium, require users to deploy hardware in order to participate and earn rewards. Helium initially launched with proprietary hardware before transitioning to open-source specifications, enabling a broader ecosystem of third-party manufacturers. (MultiCoin Capital)

Despite these efforts, the network encountered supply chain bottlenecks and issues with manufacturer reliability, particularly during its explosive early growth phase. MultiCoin Capital recommends a phased approach: early-stage networks should prioritize in-house hardware production to ensure tight quality control. Once product-market fit is validated and the hardware has been beta-tested at scale, transitioning to open-source third-party production enables faster and more cost-effective scaling.

This mirrors classic operational decisions around outsourcing versus vertical integration, with the added nuance that hardware is both a functional component and a mechanism for distributing token rewards.

Supply Side Consideration

The ease of onboarding has a direct impact on supply-side growth. For Helium’s IoT network, setting up a hotspot takes roughly 10 minutes and is a one-time process. Indoor mobile hotspots, which support Helium’s 5G rollout, require around 20 minutes for initial setup and up to 48 hours before earning rewards (Helium).

Once onboarded, suppliers need to stay engaged with the network. Helium’s supplier model is “set it and forget it.” Protocols which require active participation will typically introduce gamified aspects to network participation to maintain engagement levels. Hotspot earnings vary due to network usage and network density. At the time of writing, the Helium Tracker calculated that the average daily earnings for hotspots was $0.22, with daily network costs of $55k.

Helium’s early success in rapidly scaling its IoT coverage can be largely attributed to this low-friction onboarding process. Helium counts approximately 93k mobile hotspots in the US and almost 1 million IoT hotspots globally (Helium & Helium Tracker). [See Appendix: Hotspots for Mobile and IoT coverage maps]

Customer Sales

Enterprise sales for telecom and infrastructure services is traditionally high-touch, relationship-driven, and often requires a clear point of contact. This is at odds with the decentralized structure of most DePIN networks, where no single actor owns the customer relationship to enforce service-level agreements (a16z).

One workaround is for protocols to partner with centralized resellers or intermediaries that handle customer relationships on behalf of the network. As noted by a16z, this model enables DePIN protocols to serve enterprise customers without sacrificing decentralization at the protocol layer.

In the absence of a targeted marketing budget and strategy, growth continues to be managed by community incentives. Customer outreach becomes even more important as Helium’s unique pricing means that it must seek to fulfill niche use cases unattractive to legacy telcos. In its mobile business, Helium is at a disadvantage with respect to marketing spend and brand recognition. However, the network is uniquely positioned to deepen B2B relationships with legacy telcos for providing off load coverage in population dense areas. [See more in Market Opportunities: Mobile]

Verification

Most DePIN networks adopt a peer-to-pool model, where clients send requests to the network and the protocol selects a provider from a pool of contributors. This model simplifies coordination, enables tokenized incentives, and allows protocols to implement reputation systems or slashing mechanisms to resolve disputes or penalize bad actors.

By contrast, a peer-to-peer model, where clients contract directly with service providers, is more difficult to bootstrap. It’s also more vulnerable to self-dealing attacks, in which an actor impersonates both sides of a transaction to extract rewards. This limits the utility of tokens as an incentive layer and makes it harder to ensure honest participation at scale (a16z).

The Market Opportunities

As of 2025, the Helium Network operates in two key connectivity verticals: Internet of Things and Mobile Services. Both sectors represent significant addressable markets with increasing demand for flexible, low-cost infrastructure, where Helium is uniquely positioned to deliver value through its decentralized, token-incentivized network.

Internet of Things

The Total Addressable Market (TAM) for IoT connectivity was estimated at $10.16 billion in 2024, with a projected compound annual growth rate (CAGR) of 20% through 2033 (imarc). Growth is expected to be driven by both public and private sector demand, including applications in manufacturing, healthcare, utilities, and municipal smart-city initiatives (DATAINTELO).

In its whitepaper, Helium cited a broader IoT market size of $800 billion, though it did not specify the portion attributed to connectivity. A 2022 forecast by ERP Today projects that IoT devices will consume 80 zettabytes of data in 2025. Using $10.16 billion and $800 billion as lower and upper bounds for IoT connectivity spending, this implies an average market price per gigabyte ranging from approximately $0.00013 to $0.01.

Helium was an early mover in this space, when it launched its IoT network in 2019. CEO Amir Haleem’s long-standing thesis was that if connectivity can be delivered cost-effectively, it will unlock entirely new classes of IoT use cases. A 2025 GMSA report echoes this view, noting that existing telecom operator-led IoT deployments struggle to serve two ends of the market:

Smaller, fragmented use cases are often uneconomical under traditional pricing models.

Large-scale, cross-border projects suffer from regulatory complexity and cross border coordination friction.

In fact, 40% of enterprise buyers cite cost as a primary barrier to deploying IoT projects. Moreover, only half of global mobile operators still consider IoT as part of their long-term strategy, reflecting persistent challenges in achieving profitable IoT deployments (GMSA).

At its inception, Helium appeared to be operating on an “if you build it, they will come” model. However in complex markets like IoT, where the landscape spans both devices and services, it’s critical to clearly define the specific segment a product is targeting. When pricing introduces a differentiated value proposition that can unlock unmet demand, investors and founders need data-based forecasts of that demand and the overall market opportunity to effectively benchmark execution milestones.

Although Helium has recently shifted its focus toward scaling its mobile network, the platform continues to support and explore IoT applications. For example, in March 2024, Netherlands-based Skynet IoT announced its integration with the Helium network. This partnership enabled Helium to expand coverage into the maritime-heavy North Sea, while Skynet extended its services into Florida, enhancing cross-regional IoT connectivity. (Businesswire). Helium’s innovative approach to network building creates opportunities for edge-of-network use cases that were previously unfeasible; however, these may be too niche to become a core focus for the network.

Mobile Services

In parallel to its IoT network, Helium has expanded into the mobile services market via decentralized 5G infrastructure. As of 2024, the global TAM for mobile service revenue was estimated at $1.8 trillion, with an expected 2.8% CAGR (Data Bridge) driven by:

Network upgrades in both developed and developing markets (Grand View)

Expansion of coverage into underserved regions (GMSA)

Increasing mobile data usage (Ericsson)

Rising adoption of value-added services (Reuters)

Helium’s approach targets distinct segments of this market, particularly areas where large telecoms struggle to profitably expand network coverage and in population dense areas where hotspots can give legacy networks cost savings and network flexibility. Its decentralized model allows individuals and businesses to deploy mobile hotspots, earning tokens for providing service.

According to Escape Velocity co-founder Mahesh Ramakrishnan, the most compelling opportunity for Helium lies in becoming a mobile offload carrier, where growth can be driven through strategic partnerships. This model offers a more profitable path than that of a traditional mobile carrier, particularly in dense urban areas. In contrast, rural coverage is likely to face stiff competition from Starlink, which offers a superior solution¹. In the U.S., legacy telecom operators are constrained by high debt levels, limiting their ability to invest in network upgrades. Even as free cash flow improves, surplus capital is more likely to be returned to shareholders rather than invested in innovation. (S&P)

A major validation came in April 2025, when AT&T inked a commercial agreement with Nova Labs, allowing AT&T subscribers to roam onto Helium’s 5G network where traditional coverage is unavailable (The Block). This positions Helium not as a competitor, but as an infrastructure complement for legacy telecoms.

Helium Token: HNT

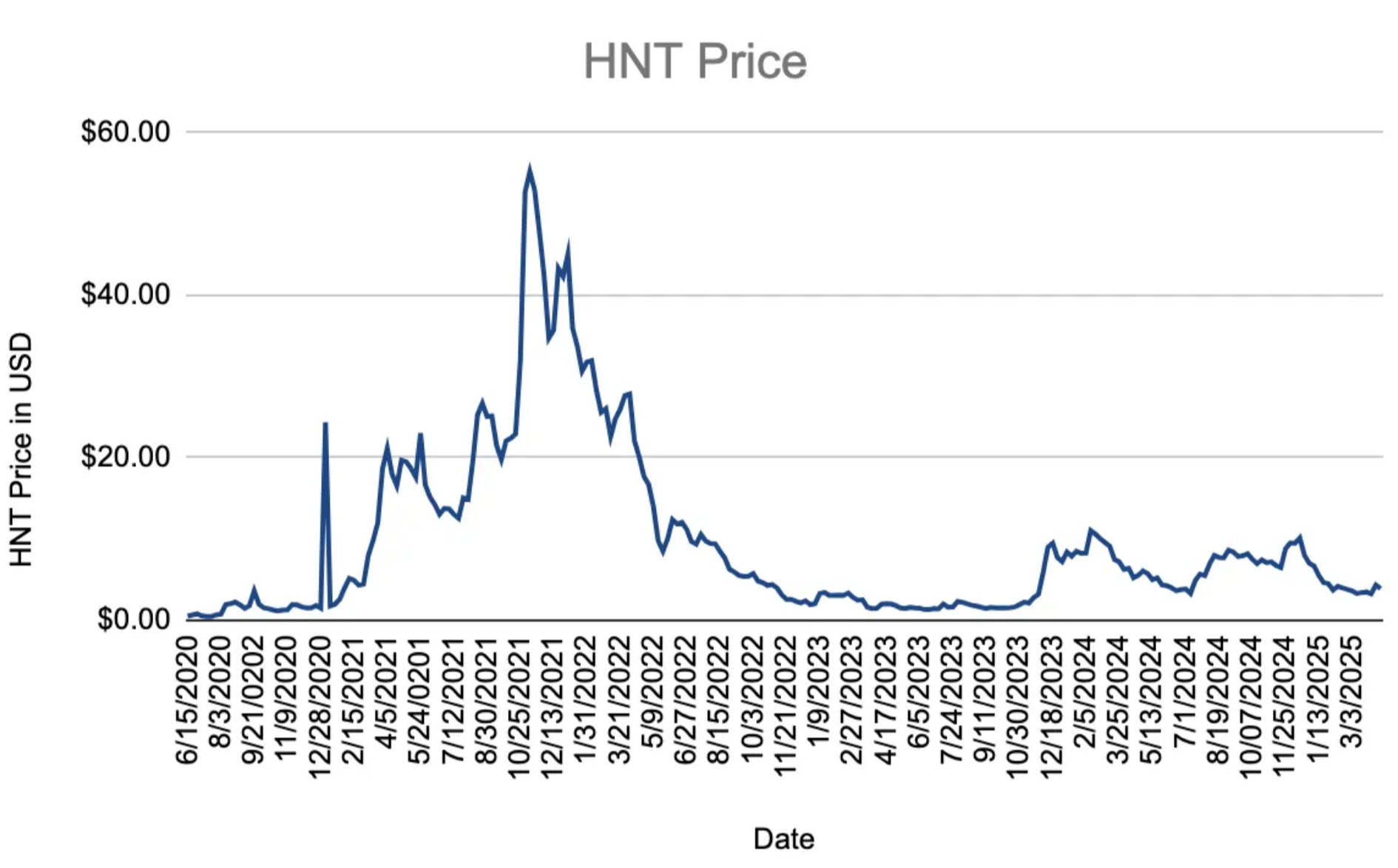

As of this writing, crypto assets are considered super-cyclical, meaning they tend to outperform traditional markets in bull cycles and underperform more sharply during downturns.

The SEC continues to assess how to classify utility tokens, which are generally not considered securities due to their core function of facilitating transactions within blockchain networks. Regardless of regulatory classification, whether as securities or transactional tools, token value tends to rise with the growth and utility of the underlying network. As such, traditional valuation methods can be applied to assess a token’s intrinsic value.

Tokenomics

source: Coinmarketcap

HNT is the primary utility and incentive token of the Helium Network and is backed by a claim to the network bandwidth (Ev3). At the time of writing, HNT is used to purchase Data Credits and to compensate Helium network hotspot operators, which function as independent last-mile fleet operators. These operators provide coverage that boosts a service provider’s signal to power Helium’s 5G and IoT networks, as well as partner networks. In practice, customers purchase Data Credits (DCs) to use the Helium network, while hotspot operators receive HNT as compensation for operating and maintaining their infrastructure.

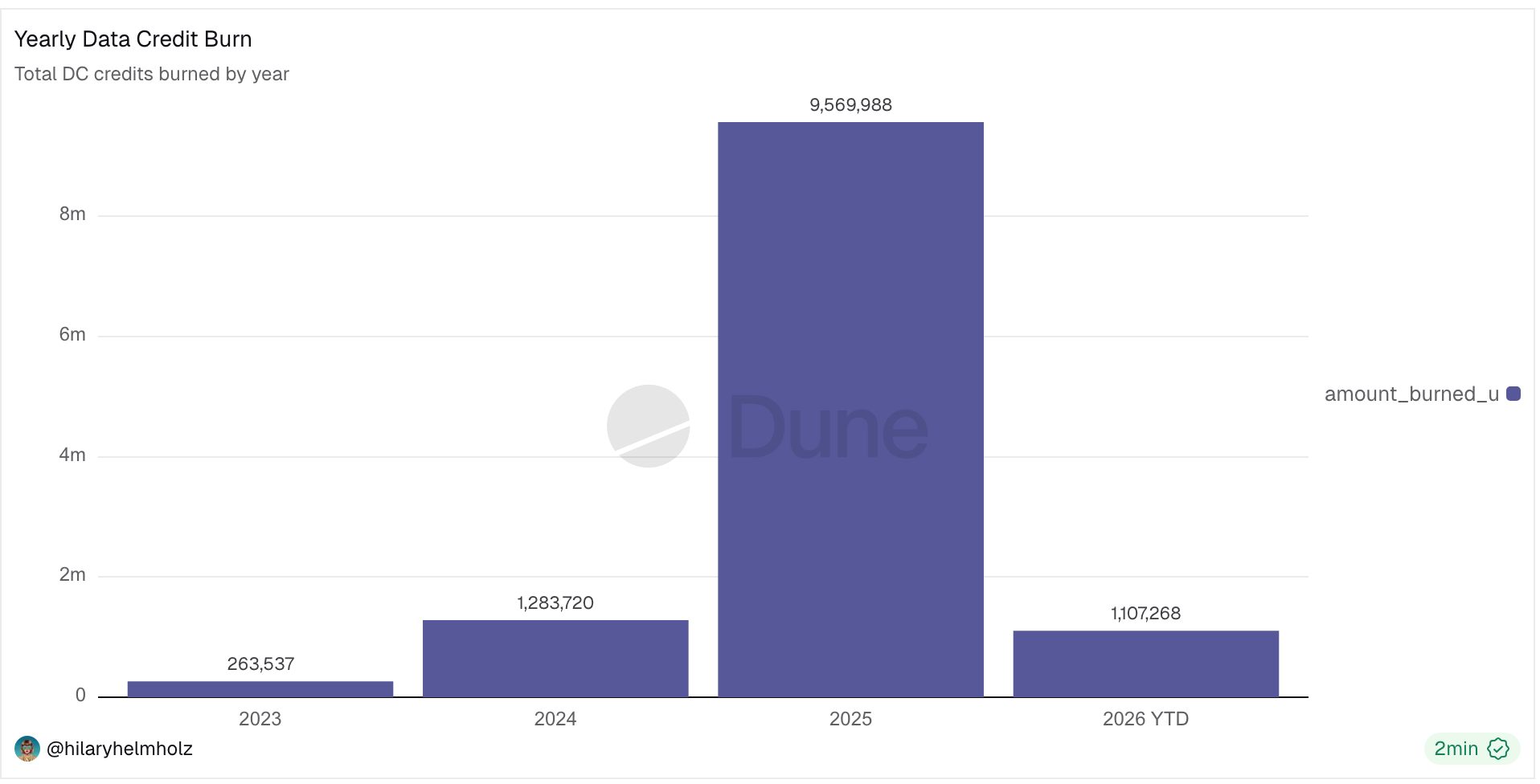

Helium employs a “Burn and Mint Equilibrium” model (BME) to align token supply with network demand. HNT is burned to create DCs, providing a built-in buyback mechanism. The network then mints new HNT tokens according to a fixed schedule to reward contributors. This mechanism ties token value directly to network activity: the more users consume services via DCs, the more HNT is burned, increasing scarcity.

To understand how value accrues within the Helium Network, it is essential to examine the tokenomics that underpin the system, specifically how HNT is minted, used, burned, and distributed among network participants. Since launch, Helium has undergone several meaningful updates that have reshaped its underlying tokenomic design.

Helium launched its business and token in 2019 on its own Layer-1 blockchain (L1). In November 2020, Helium Improvement Proposal 20 (HIP 20) introduced an approximate theoretical maximum supply of 240 million HNT and an associated minting schedule. Under this framework, newly minted tokens were distributed to network stakeholders, including founders and investors, consensus participants, Proof-of-Coverage, and Data Transfer, according to predefined allocations (HIP 20).

In January 2022, HIP 53 proposed the introduction of Utility Scores for DAOs and subDAOs, enabling rewards to be allocated based on measurable coverage and hotspot traffic rather than static role-based incentives. This marked a shift from fixed emission schedules toward performance-weighted emissions, aligning token issuance more closely with real network usage. Each subDAO determines its internal reward distribution through governance, resulting in reward splits that can differ and evolve across subnetworks. At the time of writing, a subDAO’s Utility Score is calculated as the square root of the product of Data Credits burned and the amount of veHNT delegated to that subDAO (HIP 80).

Once HNT is staked to a chosen subDAO, the position converts to veHNT, allowing holders to vote on Helium Improvement Proposals directly or delegate voting power to a proxy. In addition to governance rights, veHNT holders earn rewards that scale with both the amount of HNT staked and the duration for which it is locked.

In August 2022, HIP 70 moved Proof-of-Coverage and Data Transfer accounting off-chain to oracles. Emissions that had previously rewarded miners for data transfer, Proof-of-Coverage, and consensus were redirected to subDAOs based on their respective Utility Scores. At the time of this change, Helium had built a robust validator network, with approximately 38% of all HNT staked with validators. HIP 70 also reallocated the remaining validator emissions, approximately 6.85% of total token emissions, to hotspot operator rewards in order to further incentivize network growth.

The original L1 network was fully retired following Helium’s 2023 migration to the Solana blockchain. At the end of 2024, the network proposed HIP 138, which introduced several consequential changes. HIP 138 consolidated lessons from the subDAOs while reducing token complexity, returning Helium to a single-token model without abandoning performance-based emissions. Reward allocation was simplified across the Mobile and IoT networks, and the remaining 11 million HNT previously earmarked for founders and investors were reallocated to the broader community (HIP 138). As a steering member of the Helium Network, this change required coordination with key stakeholders, including Nova Labs, and underscored the importance of alignment in long-term network value creation. Ultimately, HIP 138 increased the network’s flexibility to direct incentives toward continued growth.

More broadly, Helium’s evolution reflects a wider industry trend toward completing investor token allocations earlier in a protocol’s lifecycle. While front-loading investor emissions can provide early liquidity and exit flexibility, it also places greater pressure on networks to generate sustained demand. Over the long term, recurring ecosystem revenues must keep pace with, or exceed, the token minting schedule in order to avoid dilution and support durable token value.

Competitive Signals

Understanding the risks and competitive pressures facing Helium, and DePIN projects more broadly, requires a multi-faceted analysis across traditional and crypto-native dimensions.

The decentralized wireless market is a small portion of the overall market in the US and globally.

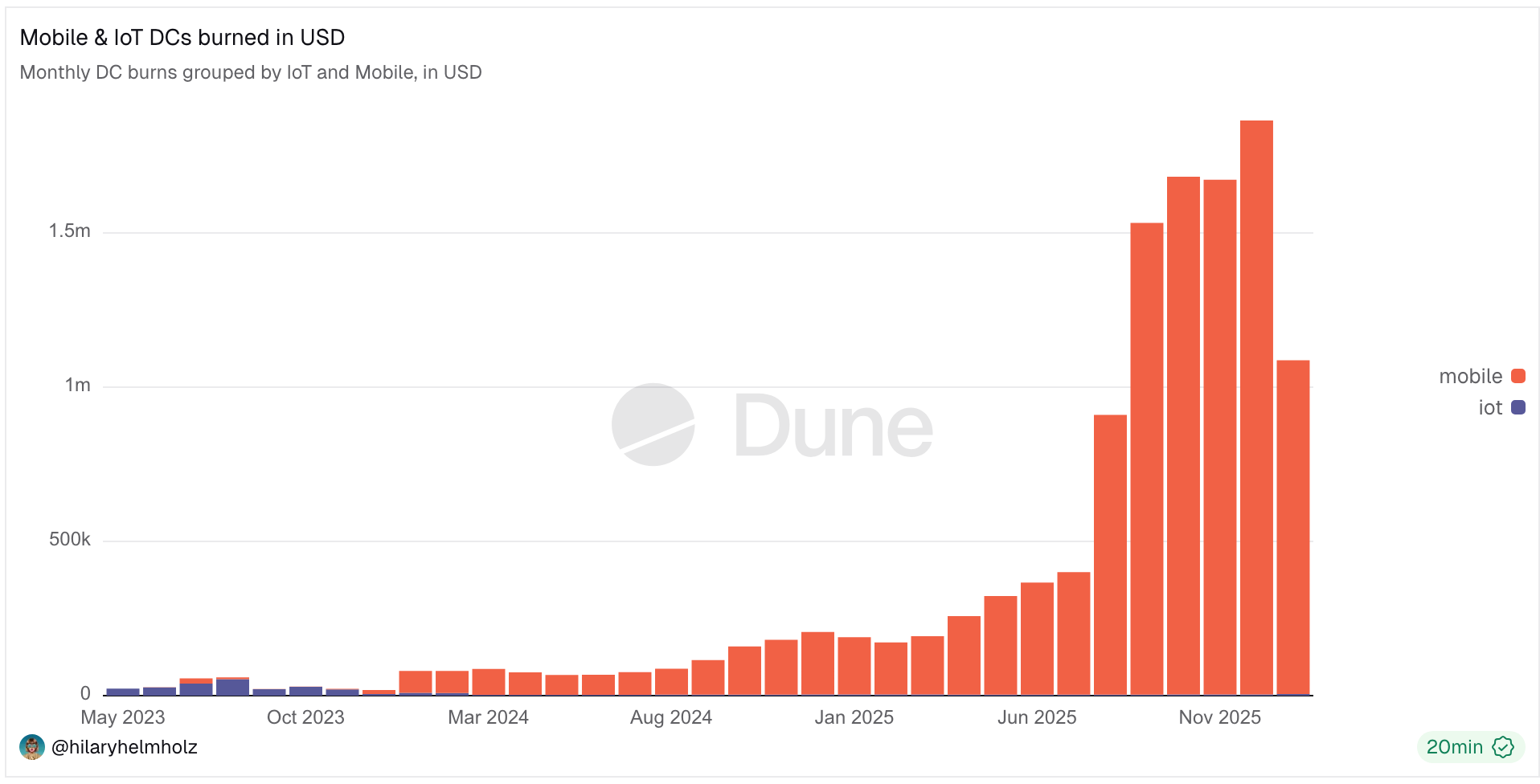

Structured as a non profit foundation, the Helium network’s financials are not comparable to legacy telecoms. Although yearly revenue in the form of Data Credit transfers shows steady growth, it is a far cry from the revenue and market share of the three major US carriers: AT&T, Verizon and T-Mobile, which ranged from $80 billion — $135 billion in 2024. (AT&T, T-Mobile, and Verizon). With respect to Helium Mobile, foundation revenues from mobile credits correspond to operating costs incurred by Nova Labs, the commercial arm delivering mobile service through the Helium Network in partnership with T-Mobile. The below chart illustrates how the mobile business has quickly surpassed IoT in terms of network usage and growth.

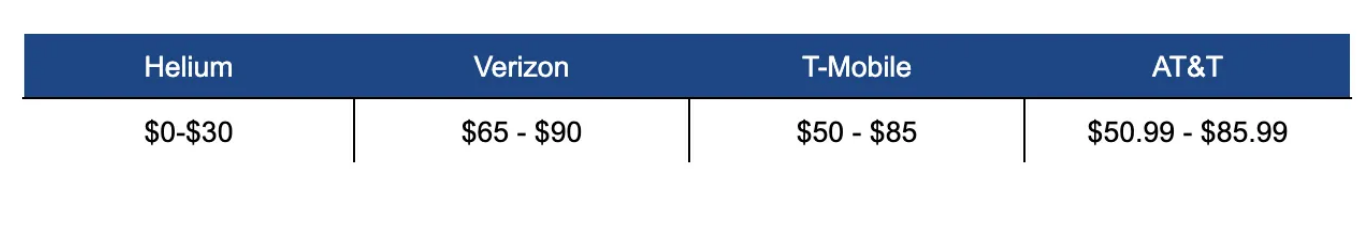

The Helium branded mobile plans offer an attractive price point to the consumer. The below table shows price ranges for unlimited plans on Helium vs. US legacy telecom networks. Helium is well below the most affordable options for all three competitors.

Plan cost current as of 4/30/2025

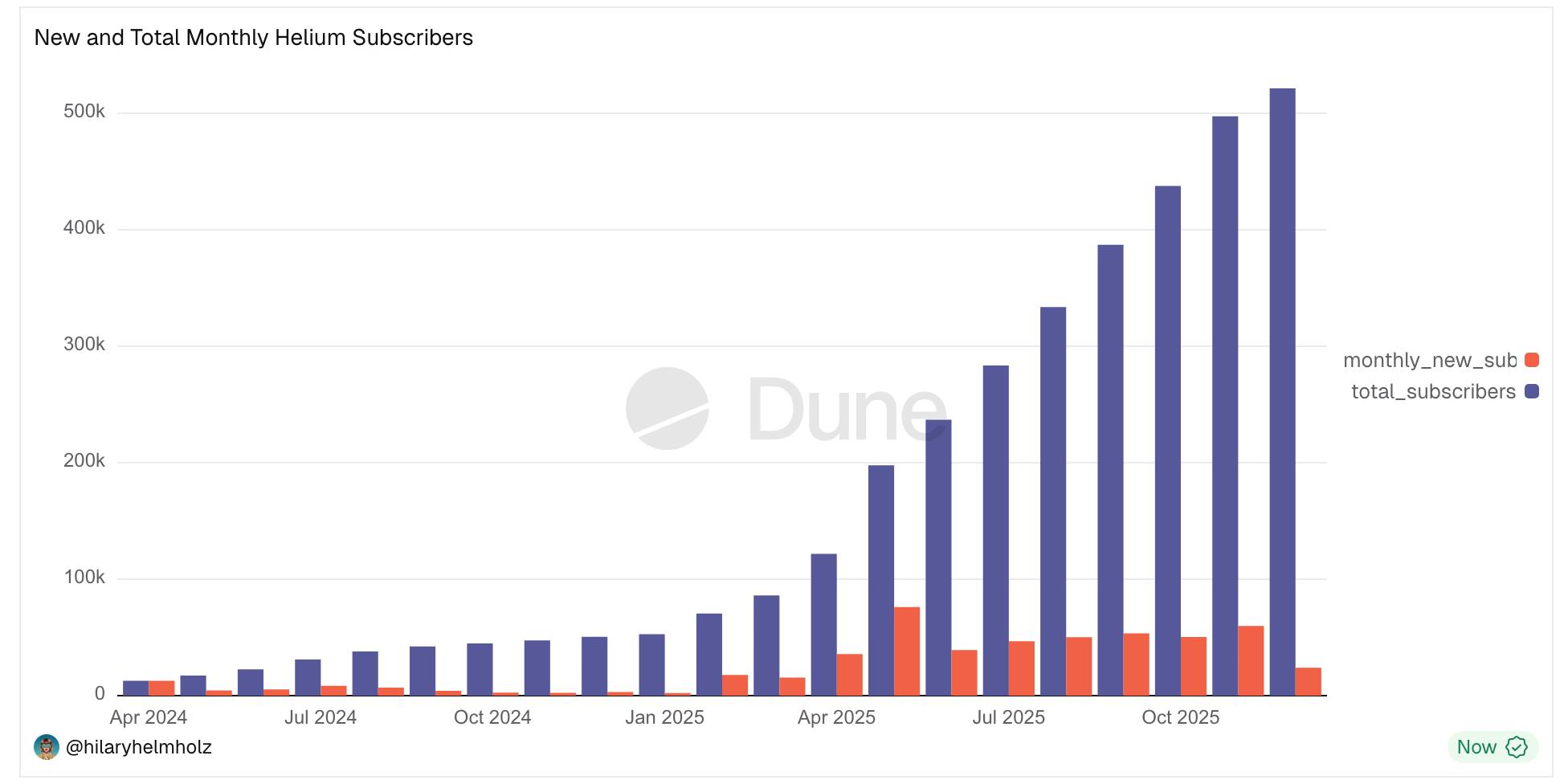

While Nova Labs does not disclose current mobile customer counts or revenue figures, the Helium Foundation tracks new subscribers (see chart below). Note that total subscriber counts also include inactive users.

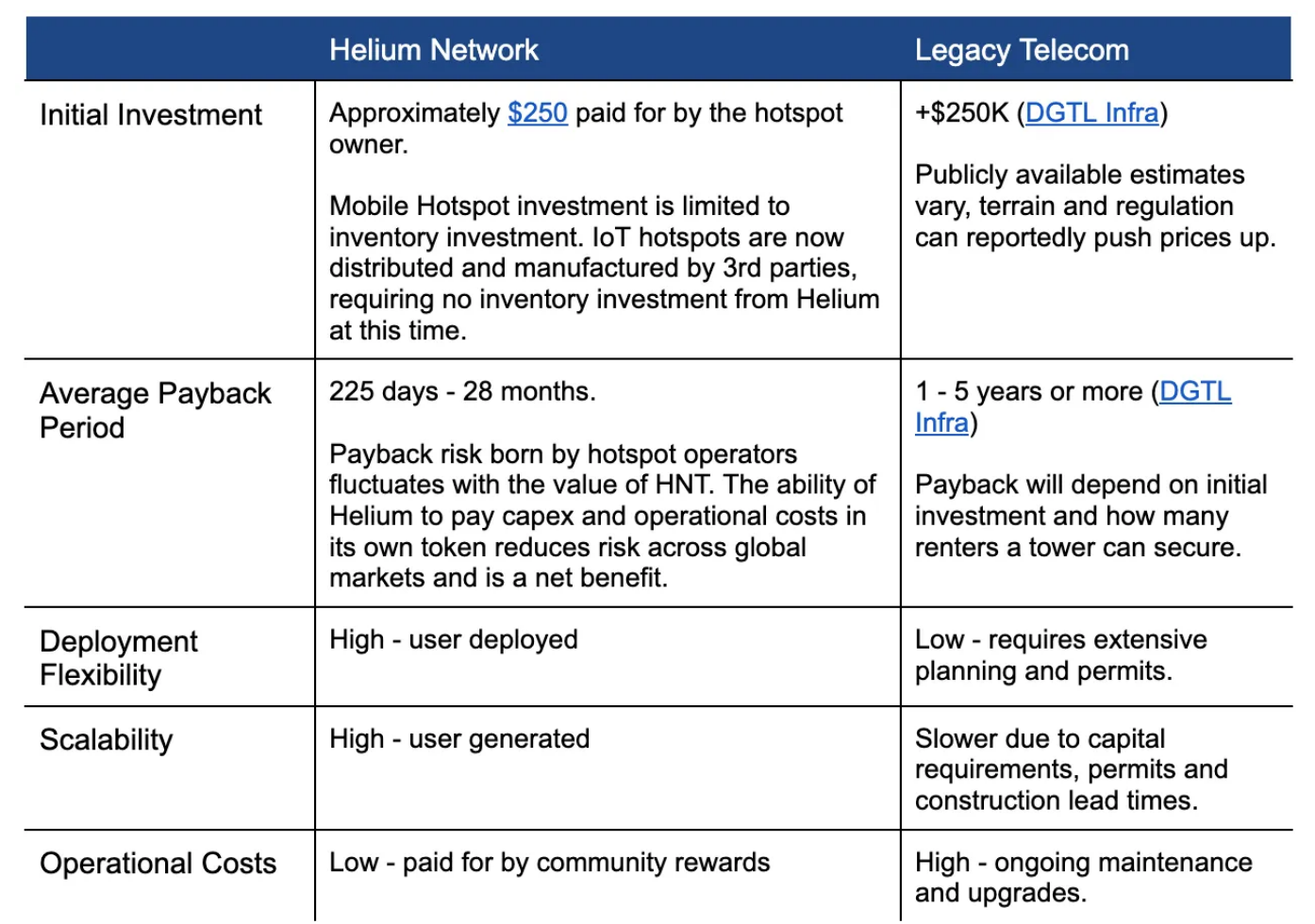

Outside of financial performance we can assess the operational flexibility of Helium by comparing capex and operational risks with legacy carriers.

The Strategic Edge in a Crowded Market

The IoT and mobile connectivity markets are fiercely competitive with the market divided up among entrenched legacy players. Helium’s unique advantage lies in its ability to deploy infrastructure quickly, cost-effectively, and unencumbered by bureaucratic and overleveraged corporate structures. By using token incentives to bootstrap supply and offload capex risk, Helium can rapidly extend coverage and create a global, grassroots network, laying the foundation for a more agile and open model of wireless innovation.

As a first mover in the decentralized wireless space, Helium enjoys a defensible lead. Rebuilding its physical network from scratch, at a comparable scale, would require capital, coordination, and time. While Helium is still too small to directly compete with major telecom incumbents, its strength lies in complementing them. Rather than aiming to disrupt large carriers outright, Helium is carving out a strategic role as a partner network, helping legacy providers fill service-level and geographic gaps. This collaborative model allows Helium to grow alongside incumbents, rather than in their shadow.

On the mobile front, Helium has pursued partnerships with established players like AT&T and T-Mobile, not to displace them, but to enhance them. This approach is pragmatic: Helium adds value by offloading operational costs, extending reach into niche or under-covered areas, and enabling low-risk experimentation with its decentralized and flexible supplier base.

From Theory to Traction: Building Value

DePIN Assessment Requires Financial Analysis

When the market does not conform to a clear consensus, traditional valuation methods such as cash flow analysis, tokenomic modeling, supply-demand models, and accrual frameworks, are applicable even in early stages where cash flows are unpredictable. While it’s often said that ‘all models are wrong,’ a well-constructed model offers a valuable framework for benchmarking operational and financial milestones, enabling agile execution in volatile environments.

Aligning incentives for the supply side, while balancing token dilution and emission sustainability, is critical for long-term health. Watch where value flows: to token holders, equity investors, or service providers and what differentiates these stakeholders?

Dual-Sided Analysis is Essential

Strong projects must solve meaningful problems for both supply and demand. Helium is compelling where centralized models are cost-prohibitive or geographically limited, particularly in specialized IoT use cases and offload mobile coverage. Just as important as identifying these use cases is developing a clear onboarding strategy for both customers and suppliers. Without effective pathways to activate and retain each side of the network, even a well-designed protocol can struggle to gain traction. Ultimately, this dual-side analysis must complement financial analysis, including product-market fit to assess whether founders and investors truly have a profitable opportunity.

Hardware Strategy Matters

Networks should ideally retain full control over hardware production during early stages to ensure quality and reliability. Once hardware is proven and standardized, decentralizing manufacturing enables scale and cost efficiency.

From Speculation to Substance

Helium’s crypto-native foundation comes with volatility. Its exposure to token market cycles introduces risk, during bull markets, speculative demand can mask underlying traction, while bear markets can dry up funding and slow adoption. Ultimately, what sets Helium apart, and what will determine its durability, is its real-world utility, revenue-generating use cases, and ability to meet genuine market needs.

Web3 introduces novel coordination mechanisms: decentralized, permissionless, and incentive-aligned, which are reshaping how infrastructure is deployed and monetized. While the mechanics differ from Web2 incumbents, the foundations of successful ventures remain unchanged: market opportunity, competitive edge, execution, and sound economic design. Financial analysis and valuation exercises are essential tools to pressure-test assumptions, clarify business models, and reveal whether a real opportunity exists. For both founders and investors, this discipline enables sharper strategic decisions and more resilient long-term planning.

Footnotes:

Ramakrishan, Mahesh. Personal Interview. 30 April 2025.

Appendix

Fundraising

Helium and Nova Labs have raised a total of $364 million to date. The most recent funding round raised $200 million, valuing the company at $1.2 billion. Of the total capital raised, $250 million was in the form of equity investment in Nova Labs, with the remaining amount raised through Helium token sales.

Hotspots

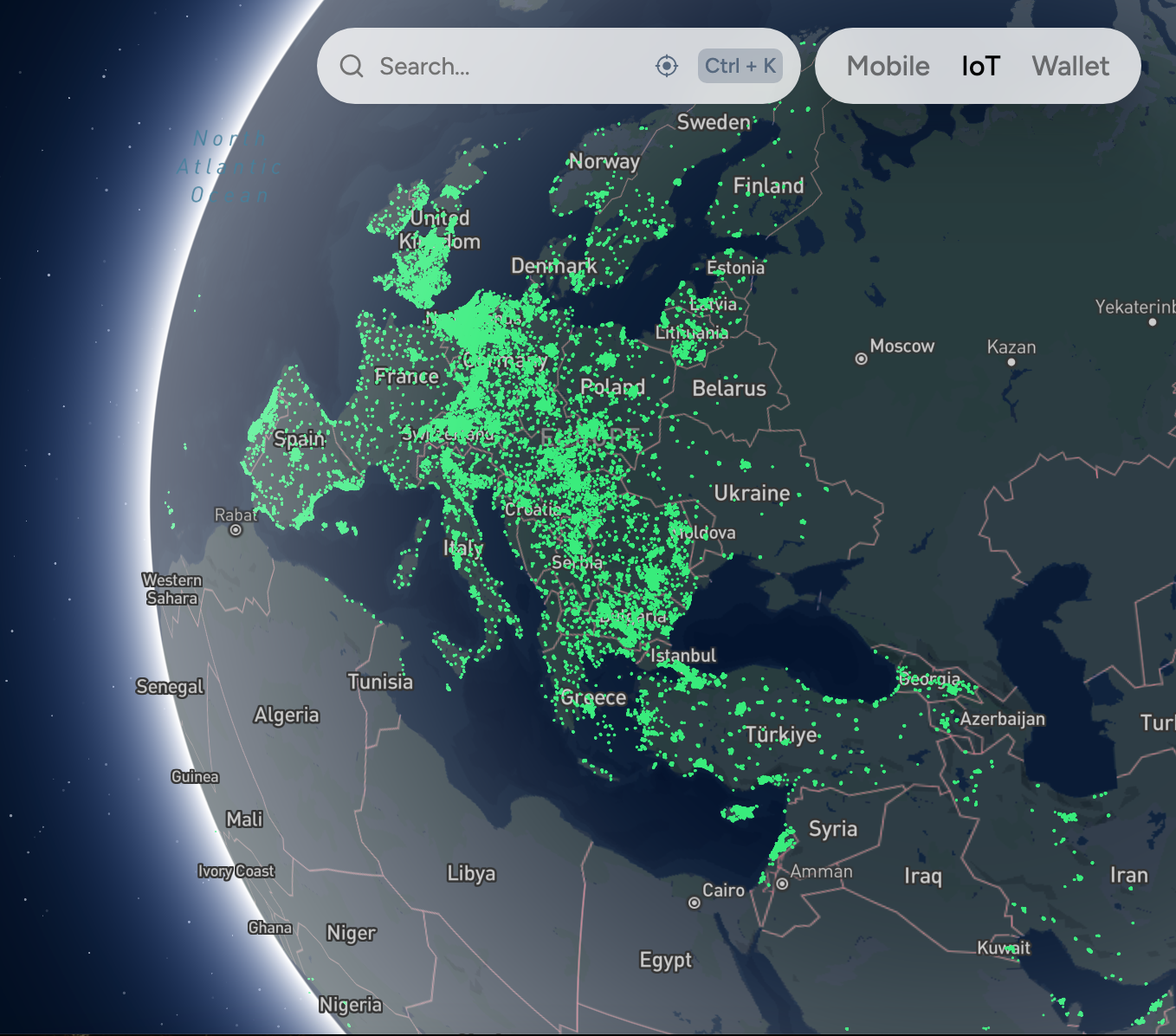

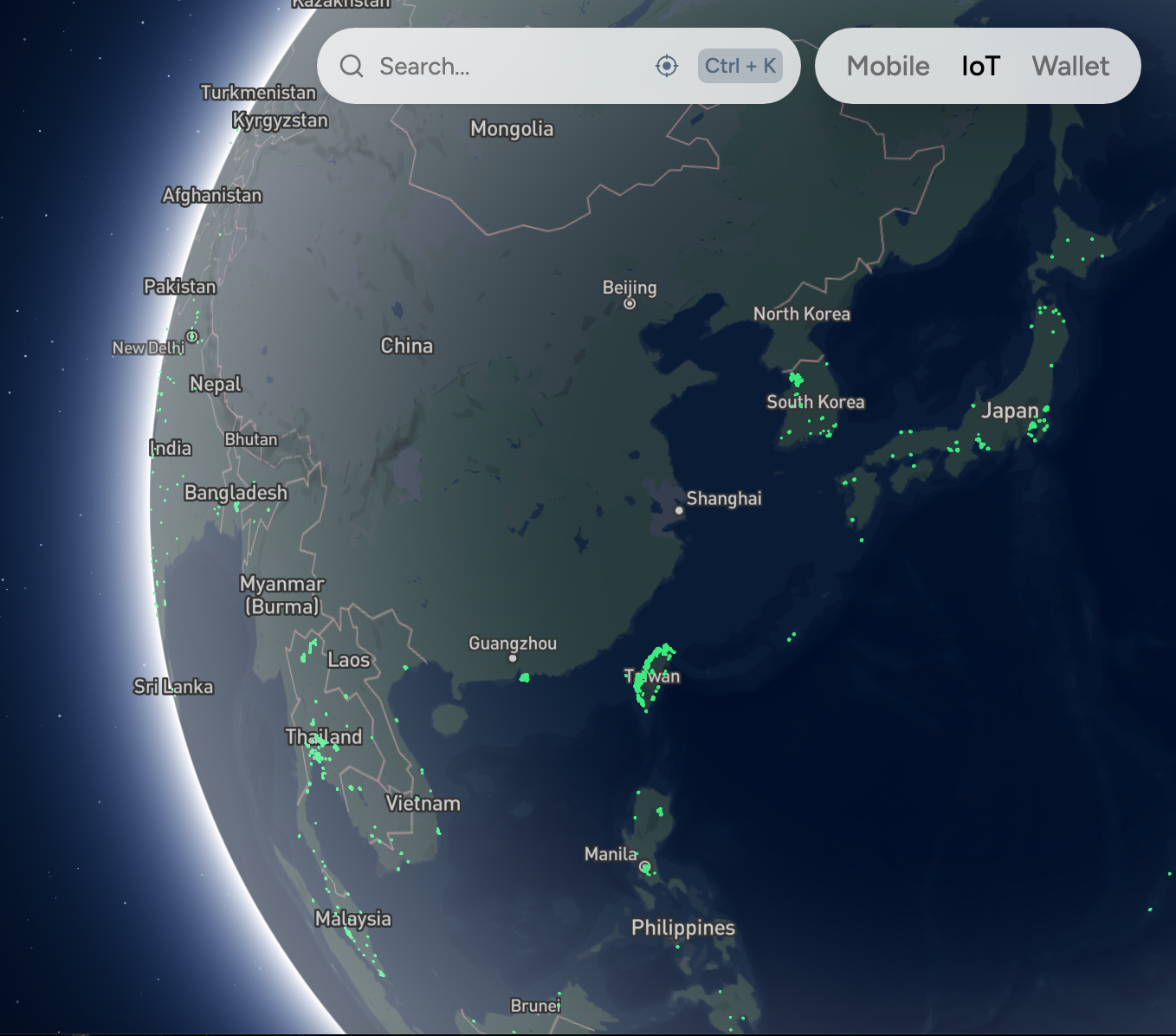

Current Mobile Coverage:

IOT Coverage

IoT coverage is concentrated mainly in the US and Western Europe. See the below diagrams from the Helium World website.